Your own credit view. Faster.

Trusted by all Top 10 Global High Yield League Table Banks and

the world’s leading Asset Managers and Hedge Funds

Accelerate your credit analysis

We provide the world's leading credit investors with specialist data and analytics to form smarter, faster credit views. We deliver detailed credit models automatically updated within minutes of earnings release, paired with workflow tools that elevate your productivity and empower your team to develop more actionable investment ideas – quicker than ever before.

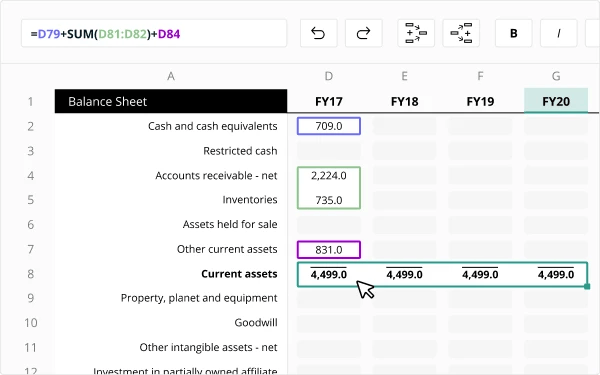

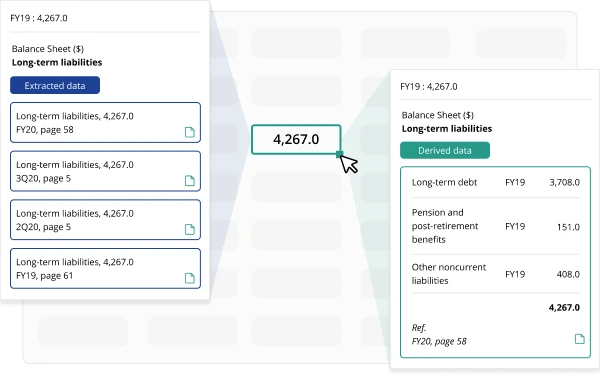

Cover more issuers with dynamic credit models

Access complete financial profiles on 3,000 HY & IG Bond, and Leveraged Loan issuers, with detailed models that are customizable, automatically updated, and always linked to source.

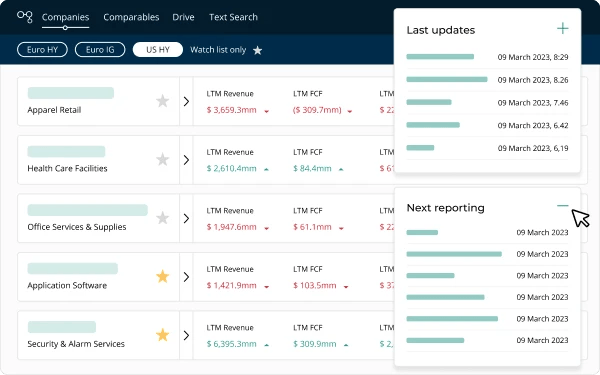

Transform your research in one easy application

Our innovative web app provides research tools custom-designed for credit investment teams, enabling convenient issuer-specific and cross-market analysis.

Faster decision-making with real-time data

Our machine-reading technology extracts & derives accurate data as soon as earnings reports are available, giving you the latest financials in minutes.

Built for credit professionals, by credit professionals

As experienced credit analysts, we feel the challenges of the industry as much as anyone: more names to cover, less time to react, fewer resources, higher costs, and greater competition. But we also know that technological innovation is the solution.

Coverage. Speed. Accuracy.

Transform your credit strategy with the market’s leading data and analytics application.