API

Integrate the market’s most complete and accurate fundamental data directly into your business systems

Boost the efficiency of your quant teams - and the accuracy of their investment analysis - by incorporating key credit market data directly into your databases via our REST API.

With custom integration supported for several programming languages, get greater control over what data you use and how you receive it - streamlining your workflows.

Leverage a fully integrated data solution

Integrate the credit market’s most comprehensive fundamental data directly into your business systems, ensuring you always have the latest numbers.

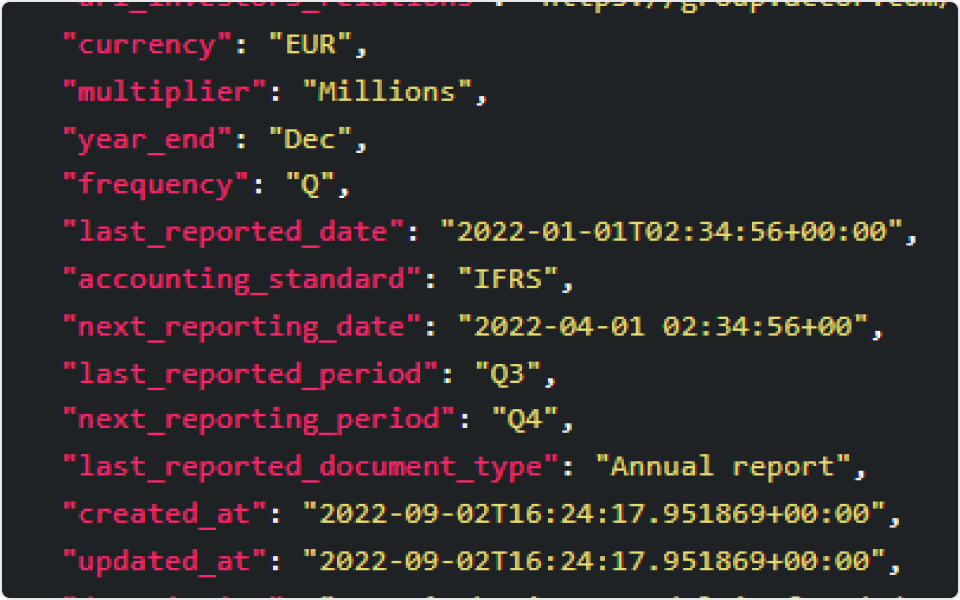

React faster with instant

data delivery

All data is refreshed as soon as new reporting has been published or within 6-hours of new issue launch.

Enhance your model

backtesting

Leverage point-in-time data for our full financial models to support more precise market analysis.

The most scalable way to access our data

Direct access

Access our data in your business systems, on-demand

Unmatched coverage

Fully supported across all our existing data licences

Faster updates

Data is refreshed directly in your applications as soon as it’s available

Flexible integrations

Downloadable SDKs for C#, Javascript, Python and Typescript

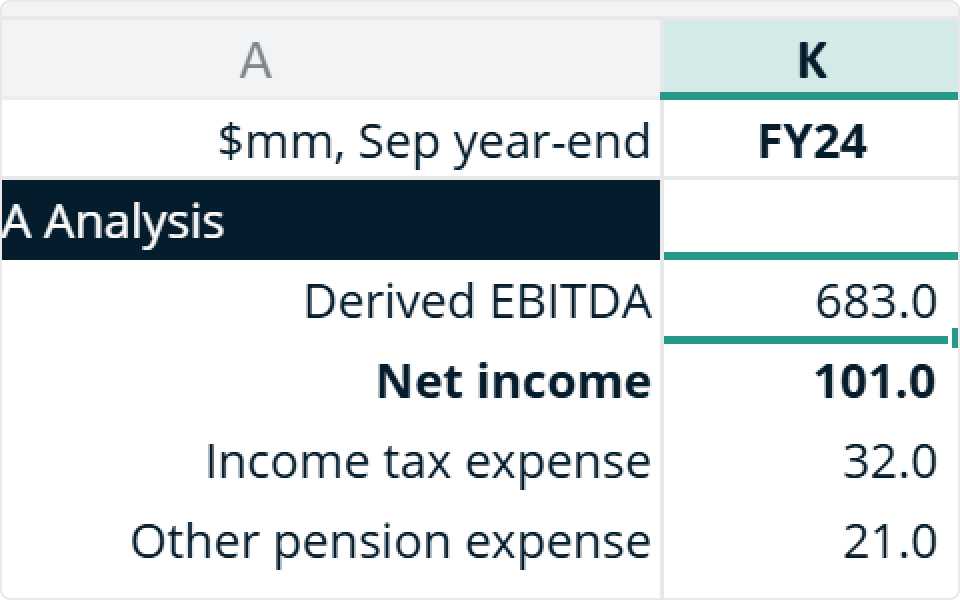

Tier I: Comparables

90+ essential credit metrics and as-reported line items.

Ideal for:

- Generating dashboards and visualizations of key credit metrics on both a single-name or peer analysis basis.

- Creating high level model templates on a single-name basis.

Tier II: Financials

580+ credit metrics from complete line-by-line models.

Ideal for:

- Signal generating models as part of a systematic overlay to a discretionary strategy or a fully systematic strategy.

- Replicating detailed / as reported models directly in their research management system.

Find out more about our API today

Transform your credit research with on-demand access to our market-leading fundamentals.