US High Yield

Maximize your credit analysis with complete and accurate data sets on High Yield USD denominated issuers

Request our coverage list

Scale up your coverage of

US High Yield bonds

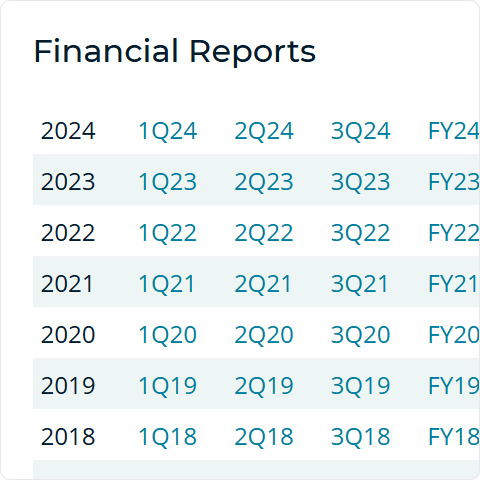

Covering over 1,100 corporate issuers, our US High Yield license includes detailed financials extracted from official earnings reports - giving you all the data you need for fundamental analysis of the US high yield space, as defined by the Markit iBoxx USD Liquid High Yield Index.

Comprehensive credit data available on-demand

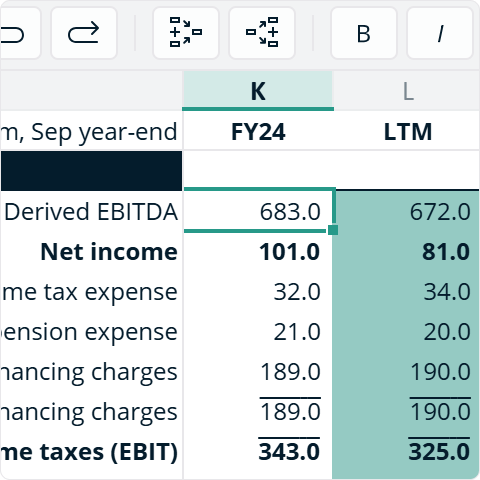

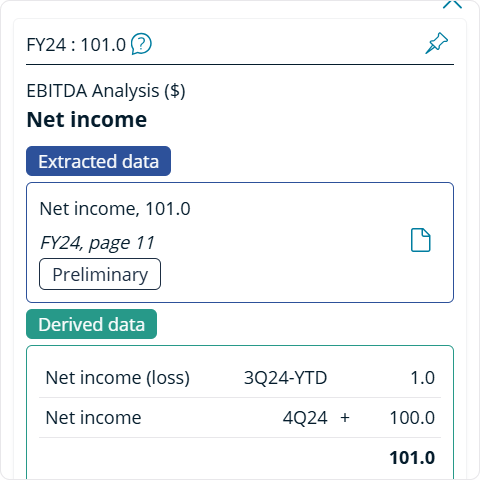

Line-by-line models including the 3 main financial statements, debt notes, EBITDA analysis, geographic & segment reporting, operating KPIs & credit metrics.

Greater accuracy and faster turnaround

Machine-reading technology systematically extracts, structures and validates fundamental data from official financial reports within minutes of release.

Support your view with additional content

Issuer summaries, reporting calendars, document libraries, pricing and reference data for outstanding loans and bonds, and automated credit memos.

US High Yield data at a glance

Coverage. Speed. Accuracy.

Unlike other data providers, automation and technology is at the heart of what we do. Proprietary tech identifies, extracts and structures fundamental data from official earnings reports in a fraction of the time it takes a human to do it, resulting in comprehensive models of greater accuracy, delivered faster.

Web App

Access our dynamic spreadsheet models, analytics and document library in one simple online service.

Excel Add-in

Stream our fundamental data directly into the credit model you know best – your own.

API

Integrate our fundamental credit data directly into your firm’s business systems & workflow.

Access our High Yield data today

Transform your US High Yield analysis with the credit market’s leading datasets.