European Investment Grade

Maximize your credit analysis with complete and accurate data sets on European Investment Grade issuers

Request our coverage list

Scale up your coverage of

European Investment Grade Bonds

Covering over 650 corporate issuers, our European Investment Grade license includes detailed financials structured in easy-to-use models - giving you all the data you need for fundamental analysis of the European investment grade space, as defined by the Markit iBoxx EUR Non-Financials BBB index.

Comprehensive credit data available on-demand

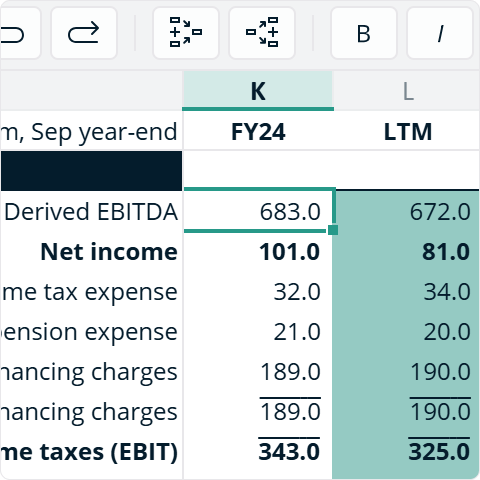

Line-by-line models including the 3 main financial statements, debt notes, EBITDA analysis, geographic & segment reporting, operating KPIs & credit metrics.

Greater accuracy and faster turnaround

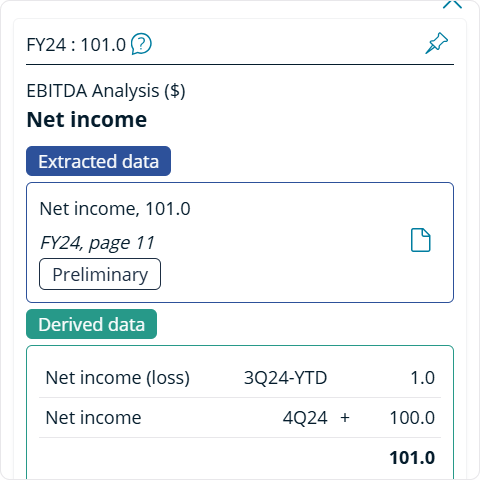

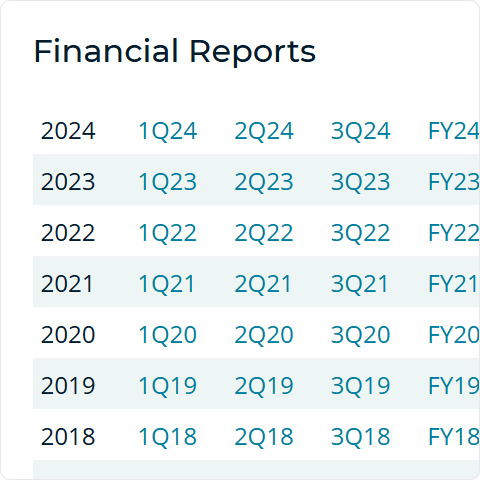

Machine-reading technology systematically extracts, structures and validates fundamental data from official financial reports within minutes of release.

Support your view with additional content

Issuer summaries, reporting calendars, document libraries, pricing and reference data for outstanding loans and bonds, and automated credit memos.

European Investment Grade data at a glance

Coverage. Speed. Accuracy.

Unlike other data providers, automation and technology is at the heart of what we do. Proprietary tech identifies, extracts and structures fundamental data from official earnings reports in a fraction of the time it takes a human to do it, resulting in comprehensive models of greater accuracy, delivered faster.

Web App

Access our dynamic spreadsheet models, analytics and document library in one simple online service.

Excel Add-in

Stream our fundamental data directly into the credit model you know best – your own.

API

Integrate our fundamental credit data directly into your firm’s business systems & workflow.

Access our Investment Grade data today

Transform your European Investment Grade analysis with the credit market’s leading datasets.