Our analysts take a look at the data from the 3Q25 earnings cycle and identify more interesting observations across US markets and sectors.

After each earnings cycle, we take some time to analyze the enormous amount of data we process with our Comparables feature - a powerful tool to view markets and sectors top down and in their entirety - to see what sector trends jump out at us across our current coverage universes.

Each quarter, we publish some of those insights in this blog as a representation of the depth of information available in our datasets, and the ease with which it can be analyzed from a top-down vantage.

Without further delay, here's our Quarterly Earnings Breakdown for 3Q25 - US Edition.

Semiconductors

In 3Q25, there was a clear divergence between US IG and US HY in the semiconductors (L4) industry due to margin expansion driven by AI and data-center demand. For US IG companies, the top line increased an average of 25.7% year over year.

![]()

![]()

Within IG, NVIDIA’s revenue mix remains dominated by its data center market which has increased 66% year over year and accounts for 90% of its total revenue.

The mix of US HY companies has meaningfully less exposure to AI-driven compute and data-center cycles. This cohort is instead concentrated in slower-growing segments such as power semiconductors, automotive/industrial silicon, and outsourced assembly. As a result of their positions in supply-chain-sensitive segments, most names saw year over year revenue decline in 3Q25.

![]()

As the sole outlier, Synaptics outperformed other US HY semiconductor companies because its strategic shift away from legacy consumer electronics components and toward higher-growth IoT and wireless connectivity made it less sensitive to supply chain vulnerabilities. Its expansion of the IoT segment of Wi-Fi, Bluetooth and edge-AI enabled platforms drove the positive YoY revenue, as shown in the revenue by product breakdown below.

Notably, Intel’s YoY EBITDA was up 125% despite its revenue being down 1.5%.This surge reflects aggressive cost reductions and shifting efforts to high-margin segments like data centers and AI products. This upward trend in profitability has contributed to FCF ticking positive in 3Q25.

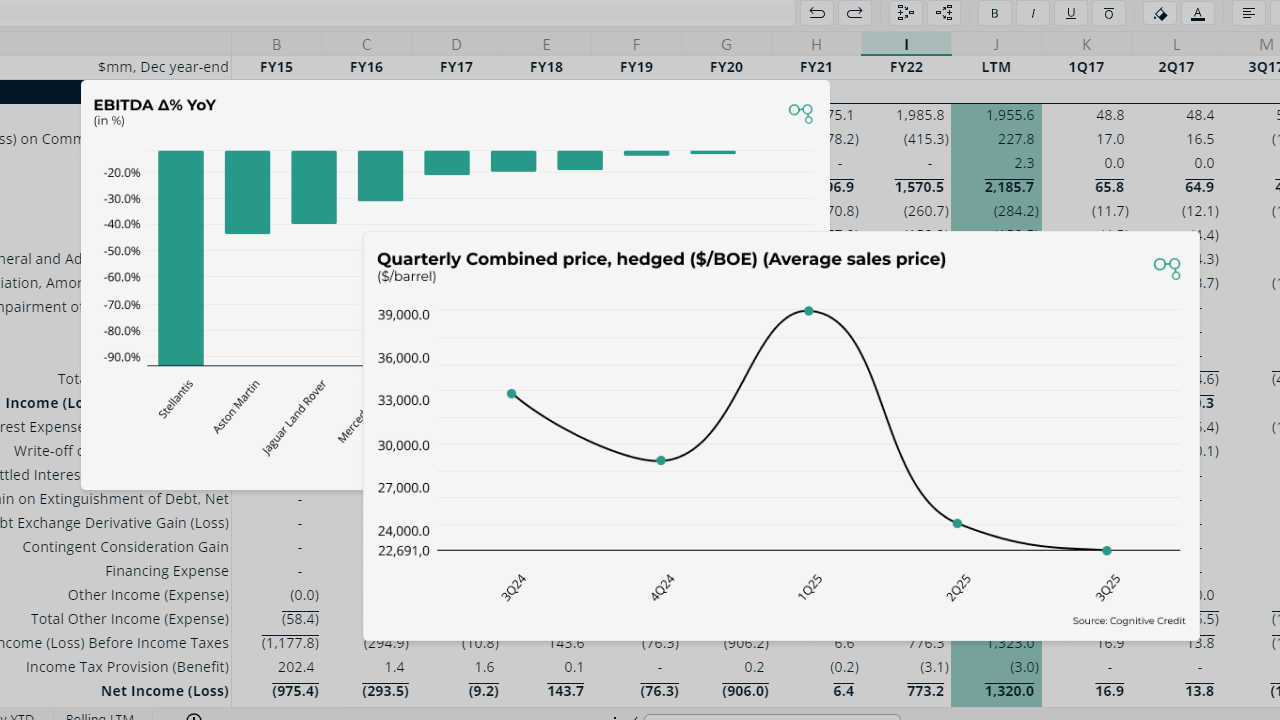

Automobile Manufacturers

In 3Q25, Automobile OEMs experienced double digit year-over-year EBITDA decline. This compression is attributable to 25% import tariffs, UAW and European wage inflation, and EV programs that are yet to turn profitable.

Japanese companies were the outliers. Their margins showed more resilience due to export profitability driven by Yen weakness and less exposure to EV programs. Labor costs in Japan are also lower in comparison to the US and Europe.

While luxury OEMs had sharp declines in YoY EBITDA and revenue, they maintained higher gross margins than mass-market OEMs. This signals less sensitivity to tariffs and labor inflation, and a more resilient demand attributable to a wealthier consumer demographic.

Oil & Gas

Although commodity prices were lower in 3Q25, Oil & Gas E&P companies showed strong year over year results. The two main factors driving these results are larger production volumes that offset lower commodity prices, and weak 3Q24 comparables which were held back by weather impacts and pipeline constraints.

For example, Viper Energy Partners saw volume increases from 3Q24-LTM to 3Q25-LTM in oil and natural gas production which more than outweighed reduction in average sales price. This has supported the company’s continued upward trend in EBITDA.

Analyze the entire market, faster

Cross-market analysis like the above is easy with Cognitive Credit. Our Comparables feature offers a top-down view of

all our fundamental data across our four coverage universes (European & US High Yield, and European & US Investment Grade), allowing you to find relative value opportunities across your markets, sectors and companies quickly and conveniently.

To see how our cross-market data and analytics could help your business, request your demo today.