Our analysts take a look at the data from the 1Q25 earnings cycle and identify more interesting observations across US markets and sectors.

After each earnings cycle, we take some time to analyze the enormous amount of data we process with our Comparables feature - a powerful tool to view markets and sectors top down and in their entirety - to see what sector trends jump out at us across our current coverage universes.

Each quarter, we publish some of those insights in this blog as a representation of the depth of information available in our datasets, and the ease with which it can be analyzed from a top-down vantage.

Without further delay, here's our Quarterly Earnings Breakdown for 1Q25 - European Edition.

Utilities

The European HY Utilities space includes a diverse set of issuers spanning water, gas, electric utilities, renewables, IPPs, and energy traders. In 1Q25, results varied due to weather impacts, energy prices settling, and differences in how much companies rely on market-based versus regulated revenues.

Revenue trends in European utilities and IPPs varied, with some companies showing modest growth and others experiencing declines due to market and weather factors.

European Energy was the clear outlier with a +498% YoY revenue jump, driven largely by the sale of newly developed power parks rather than recurring generation. Such revenue spikes are typical for the company, reflecting the timing of project divestments in their build-operate-sell model.

Traditional utilities like EDF (-1.3%), RWE (-3.5%), and Centrica (-4.0%) posted muted or negative revenue growth, weighed down by soft trading and weaker wind output.

On the upside, names like Energo-Pro (+24.2%), PPC (+27.2%), and Eustream (+135.0%) saw meaningful growth.

RWE

RWE’s 1Q25 performance underscores the operational headwinds facing merchant-exposed utilities. The company reported around 25% YoY drop in adjusted EBITDA to €1.3 billion, driven by low wind output and weak trading, a pattern consistent with broader Central and Northern European conditions this quarter. While revenues dipped modestly by 3.5%, the more significant signal came from margin pressure and underutilized generation assets.

Despite short-term challenges, RWE pushed ahead with its energy transition strategy investing €2.7 billion in the quarter and maintaining over 11 GW of renewable capacity under construction, spanning offshore wind, solar, and batteries. The company also launched a €1.5 billion share buyback, reflecting confidence in long-term earnings normalization. Free cash flow remained negative, shaped by high capex and working capital swings, but this is consistent with RWE’s front-loaded investment cycle.

Total generation across RWE Group amounted to 35,386 GWh, a rise of 5% YoY, driven by higher utilization of gas-fired power plants in Turkey and the Netherlands, which helped offset weak wind and hydro output. Renewables generation in 1Q25 reached 13,125 GWh, down 6% YoY as a result of unusually poor wind conditions and reduced precipitation in Germany and the UK. Get detailed KPIs for RWE here.

EDP

In contrast, EDP and its renewables arm EDPR delivered one of the most stable sets of results in the peer group. 1Q25 revenue grew 8.7% YoY, supported by strong Iberian hydro performance and geographically diversified renewables output that sidestepped the wind shortfall seen elsewhere.

The company also executed a €100 million share buyback and continued to fund growth with internally generated cash, highlighting a more cash-efficient model than capex-heavy peers.

While free cash flow was modest, it remained structurally positive due to lower capital intensity and strong generation performance marked by a 5% increase in total output to 18,296 GWh, 91% renewables share and record Iberian hydro dispatch levels supporting flexible generation. Click here for detailed KPIs for EDP.

The quarter highlighted a clear split in performance between asset-light IPPs with strong project monetization (e.g., European Energy) and larger incumbents navigating volatile generation and capital-intensive transitions. Differentiation will likely persist into next quarter as earnings quality, capex flexibility, and exposure to regulated assets define credit momentum.

Media & Entertainment

The Media & Entertainment sector spans broadcasting, cable & satellite, advertising, publishing, and movie/entertainment companies. 1Q25 results reflected mixed fundamentals, shaped by the strength of digital-native platforms, soft linear ad trends, and uneven content monetization.

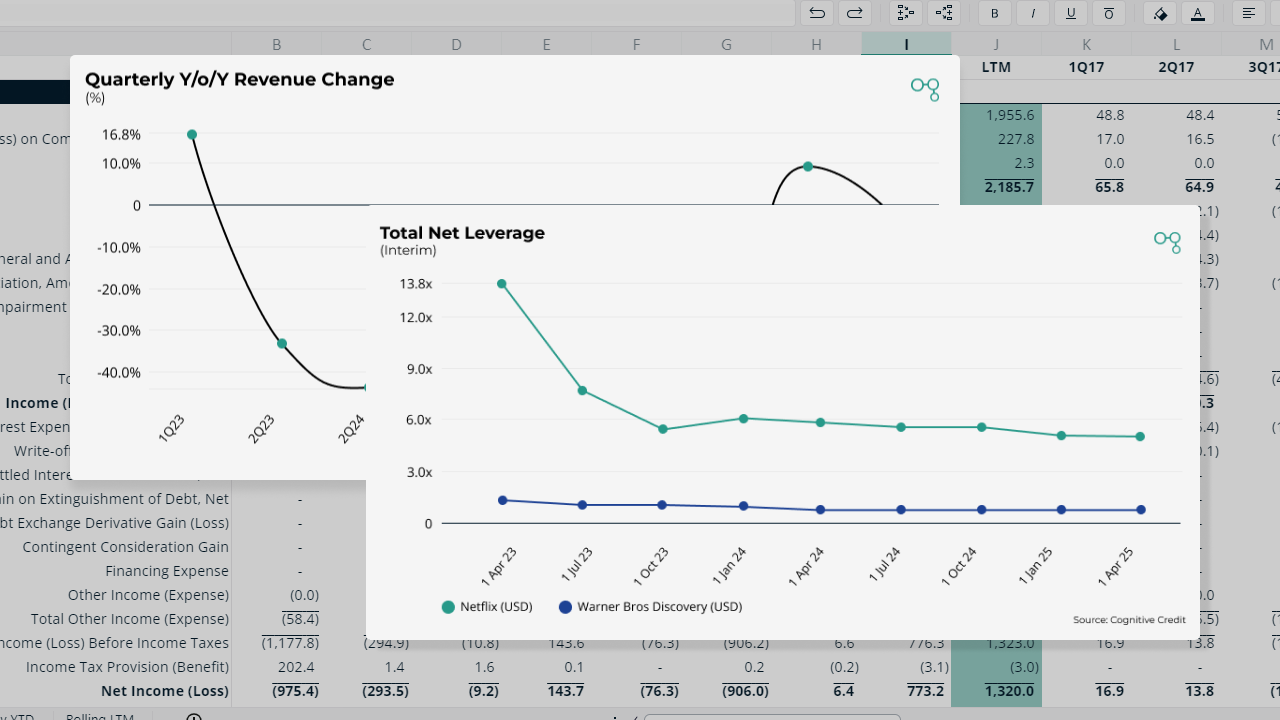

Revenue performance in 1Q25 was generally muted, with most traditional media seeing flat to modest growth. In contrast, digital-first players like Netflix stood out with double-digit gains, highlighting the sector’s bifurcation between legacy businesses and streaming platforms.

EBITDA performance in 1Q25 exposed a sharper divide than revenue, with digital-native platforms benefiting from scale and margin expansion, while legacy operators faced compression. Netflix led with a +43.6% YoY increase, while ITV (–31.9%), Ubisoft (–31.2%), and Bertelsmann (–21.1%) posted steep declines amid softer monetization and fixed cost drag.

Netflix

Netflix delivered the strongest performance in the group, with both revenue and EBITDA growth increase. Solid subscriber additions, pricing adjustments, and disciplined content investment drove margin expansion.

The number of paid memberships crossed the 300 million mark at the end of FY24 reaching an all time high of 301.6 million. An analysis of the Average Revenue Per User (ARPU) by Segment YoY growth reveals consistent growth across all segments where the Europe, Middle East, and Africa (EMEA) segment grew by 15% and Asia-Pacific (APAC) segment recorded a growth of 23%.

With net leverage at 0.7x and interest coverage above 20x, the platform remains structurally well-positioned to scale investments while maintaining balance sheet strength.

For detailed Netflix KPIs, go here.

Warner Bros. Discovery

On the other end, Warner Bros. Discovery saw a (9.8%) drop in revenue and a (2.0%) decline in EBITDA highlighting the impact of softer advertising, underwhelming streaming growth, and cost-heavy legacy operations.

Although the number of global streaming subscribers has steadily increased and the global average revenue per user (ARPU) has remained relatively stable, the key reason for the drop in revenue is the decline in advertising and content revenues (1Q25 Press Release).

Net leverage remained elevated at 5.0x, with limited interest coverage of 3.4x, indicating limited financial flexibility as the company works through its turnaround phase.

The quarter underscored a stark divide where streaming-first platforms are delivering robust growth and cash generation, legacy media operators continue to grapple with structural transition, cyclic ad demand, and capital intensity, making platform positioning and cost agility key differentiators going forward.

Analyze the entire market, faster

Cross-market analysis like the above is easy with Cognitive Credit. Our Comparables feature offers a top-down view of

all our fundamental data across our four coverage universes (European & US High Yield, and European & US Investment Grade), allowing you to find relative value opportunities across your markets, sectors and companies quickly and conveniently.

To see how our cross-market data and analytics could help your business, request your demo today.