The thought of changing the way you analyze a credit is enough to bring any credit professional out in a cold sweat. But bringing technology into the process doesn’t have to be a big bang - and you don’t have to go cold turkey on your traditional spreadsheet model to reap the benefits of technological innovation.

In my previous post on how technology now solves the problem the offshore analyst model was meant to, I mentioned some of the drawbacks to using technology in the credit analysis process. Often, the gains won through accuracy and automation imply a loss of customization and flexibility. Whichever route you go down, you’ll receive a spreadsheet built by someone else, using somebody else’s methodologies, that you then have to get to grips with. Not ideal, but you persevere because it’s better than the alternative - building one yourself.

But what if it didn’t have to be that way? What if your partner not only supplied you with the models you required, but also gave you full control over how those models looked and felt? Additionally, what if your provider was able to reduce all of the manual burden on you and your team by automating data entry for live earnings updates?

Update your customized Financials with one-click

This week, we have launched a significant enhancement to our application. Building on the fastest and most accurate credit data in the market, you can now edit and save customized versions of credit models within the Cognitive Credit application. Crucially, this release allows you to leverage our machine-reading technology to update any saved credit models as soon as new earnings information is published. Simply hit the update button and your model will instantly auto-populate with the latest reported figures.

That means no more frantically flicking through presentations, updating models in pursuit of a quick initial view. No more spending weeks in-between reporting seasons manually entering numbers into spreadsheets. And no more wondering which model to prioritize when 5 equally important companies report at 7am on the last Thursday in February. In just one click of a button, you’re completely covered. It really is that simple.

Unlock months of potential analysis capacity

We know what you’re thinking - this sounds too good to be true. Does it really work? The short answer is YES.

It’s well documented that people don’t like change, so we know that to get you to do fundamental credit analysis in a different way, the rewards have got to be huge. And they are.

The ability to access our pre-built, as reported, financial models and update them with one click of a button will save you hours of manual work each day, days of manual work each week, and weeks of manual work each month. Across the team, this will translate into months of additional capacity every year.

So, how does it work?

Let’s assume that the general maintenance limit for analysts covering performing HY is around 50 names. Realistically, few analysts keep all 50 models current and updated for the latest numbers at all times. Besides the fact that there just aren’t enough hours in the day to keep all those models updated in the way you like them, names tend to ebb and flow in terms of topical importance. Rushing to update a name 6 quarters out of date is a familiar exercise for almost all credit analysts. Subsequently names tend to be tiered based on view:

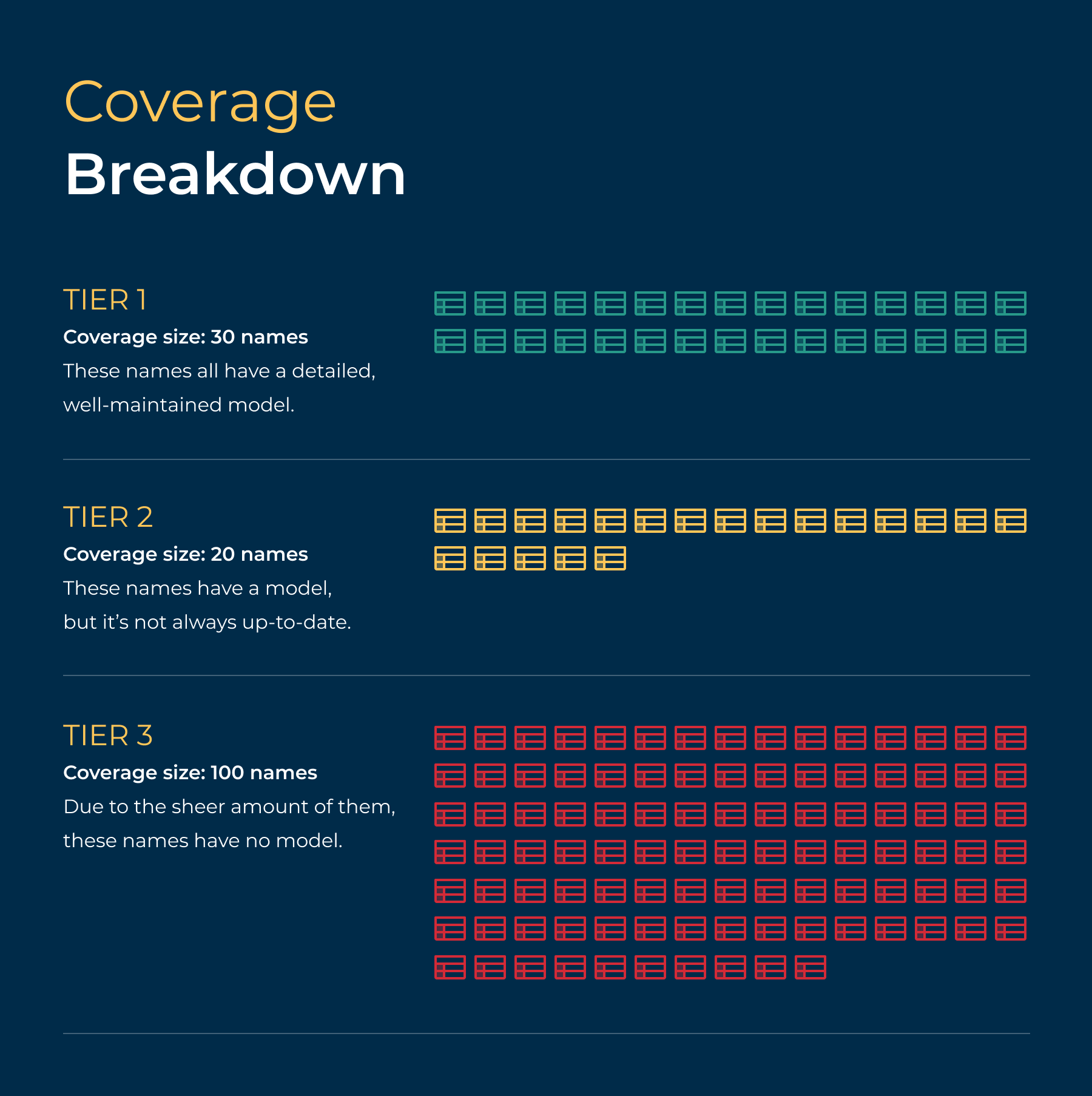

Tier 1 are the ones you have a strong view on. You feel like you know everything you need to know about the name. You have a detailed model and a strong view. This tier is probably circa 30 names strong.

Tier 2 are the ones you know enough about to wing it, but would not necessarily feel comfortable being seriously questioned. These are the ones you have a model for, but it’s almost certainly stale - oftentimes by many quarters. The name was interesting at one point 3 years ago, but the refinance went through and any potential liquidity event was pushed out for a few years. You probably have about 15-20 of these names.

Tier 3 names are the aspirational ones. The bucket of credits you periodically come across and think to yourself ‘I should really do more work on that name’. Unfortunately it never happens because you’re perpetually in a state of refining and updating your Tier 1 and wishing you had more time to look at your Tier 2 names. You probably have between 30 and 500 of these names, depending on your firm’s analyst-to-issuer ratio!

Based on the above, let’s do the math.

You have 20 Tier 2 names at any one time. Over the course of a year, you rotate your Tier 2 coverage 3 times, as the market moves, meaning you have 60 Tier 2 names in total. It takes you 6 hours to go through the process of creating a financial model - gathering the information and spreading the numbers. That’s 360 hours of data collection and data entry over a year.

In any one reporting season, you will have 20 Tier 2 names live and it takes you an hour to update each model. That’s an additional 80 hours a year of manual updating per year.

That means you spend 440 hours (or 44, 10-hour days) a year maintaining models on your Tier 2 names.

That’s about 20% of your year on names that you’re hoping don’t become topical because you don’t know enough about them to have a strong opinion.

10x your Tier 2 coverage.

With our one-click updates, not only do you have all the information available to shortcut the model build phase, but you can also update those models instantly. You spend 20 minutes on the initial customization of your model and then every time they report you can update the numbers with the click of a button (we’ll say 10 minutes to give you time to get focused).

So now, you cover 60 Tier 2 names over the course of a year and it only takes you 24 hours to build and customize all those models. You still only have a max of 20 names at any given time, meaning update time for all your models reduces to 16 hours per year.

That means you now spend 40 hours (or 4, 10-hour days) on your Tier 2 models per year.

The bottom line: with Cognitive Credit, you could reduce the time you spend on manual processes by up to 90%, and cover 10x as many Tier 2 names as you previously did. Alternatively, you could have your own opinion on 5x as many Tier 2 names at any given time - and still have time left over.

It’s easy to get started

If you’re an existing client, this functionality is already available to you. To help you get started, we’ve added an already customized "mock up" Financial to your Drive. Simply go to your Drive, open up the file and save it as your own. Then click the yellow update button in the bottom left corner.

You’ll be able to select your update settings and then watch the model populate with new earnings information immediately. By default, new updates will be highlighted green. Simple.

Not yet a Cognitive Credit client?

No problem - just get in touch with us today and we’ll show you how we can double your market coverage overnight.