For Credit Analysts, dealing with financial restatements is one of the more frustrating parts of the model-building process. Here’s why they matter, and how we highlight them in our credit models.

As a Credit Analyst, one of the most annoying things a company can do is restate its earnings.

Suddenly, I have two periods of data to enter into my painstakingly crafted credit model - this quarter and the corresponding period from a year ago (plus year-to-date perhaps!). Do I type over the historical period and lose that data? Or do I insert a new column and rebuild all my spreadsheet formulas?

I have to do this under the usual time pressures, especially as a large restatement could well indicate a material strategic move by the company that I need to evaluate ahead of, or at least in-line with, the rest of the market.

And, besides the practical spreadsheet tasks, I also now have to quickly form my own view on what the company has reported. My earnings forecasts were based upon the old reporting format, and so to interpret the new earnings report I must quickly seek to understand what is now a 'good' or 'bad' measure for various earnings or financial metrics, on the new basis of reporting.

So, financial restatements do ‘matter’.

Why do financial restatements happen?

A financial restatement occurs when a company discovers an error in a previously issued financial statement. If that error contains a "material" inaccuracy, the company will then revise one or more of its previous financial statements to correct it. The reasons for a restatement can vary, but most are the result of simple accounting mistakes or misinterpretation. However, some can point to more serious issues such as fraud, noncompliance or incompetence.

I’m sure many restatements are justifiable - a re-appraisal of how items are accounted for based on the ongoing review of a company’s financial reporting methods or as the business evolves over time (or as accounting standards change). Perhaps a division has been put up for sale and hence moved into 'discontinued operations'.

Maybe the company has made a minor adjustment to its financial reporting - but there must have been a driver behind it. Has there been an accounting policy change? Could this mean the company is presenting its numbers in a more beneficial way? Could it be a defensive response to seek to alter a particular financial ratio or metric that the market might focus on, and is deteriorating?

For example, could gross margins be under pressure, and so the company has managed to come up with a convenient reason for shifting COGS into Other Operating Expense, hoping that this helps it escape scrutiny from the investment community?

Maybe the company has some assets or operations which are dragging margins down materially but it really has no hope of selling them for anything like the value reflected on the balance sheet. But to see it through a difficult period, it is convenient to present them as Discontinued Operations to remove them from headline earnings figures before abandoning the ‘sale’ or taking a writedown at a later date, when the core business (perhaps under new management) is robust enough to absorb the adverse effects.

More menacingly, material restatements often serve as an early warning indicator of financial stress. It’s these sort of examples that credit investors, with their asymmetric risk-reward profiles, have to be particularly wary of. It is well understood by analysts that significant financial restatements signal poor financial controls and/or corporate governance, with such developments commonly leading to a series of subsequent negative corporate announcements and downward revisions to a company’s credit profile.

How we deal with financial restatements

At Cognitive Credit, we've been there, and we understand the importance of both recognizing restatements and being able to hone in on them quickly to understand what's going on.

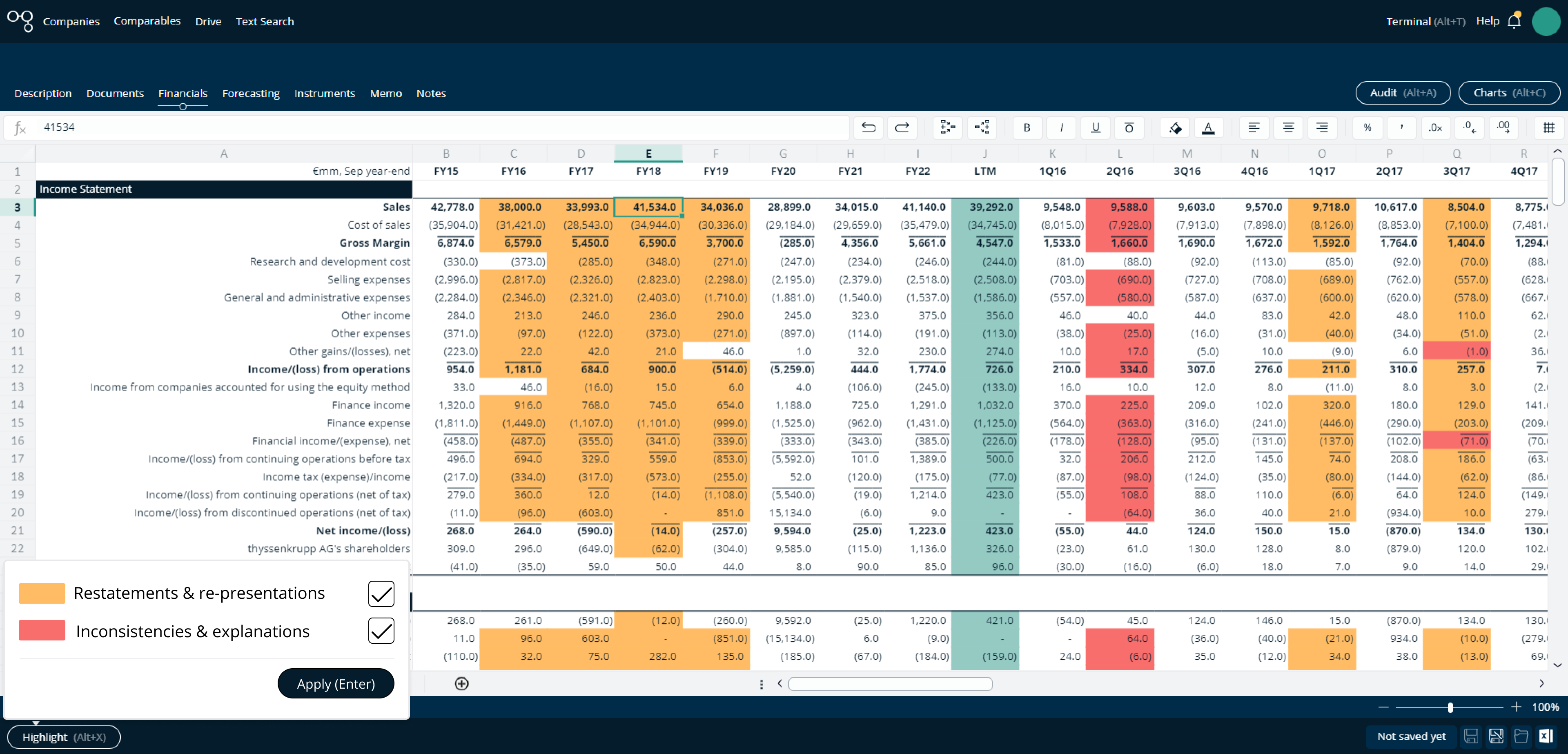

That’s why when we process new earnings reports, we don’t simply update our models for the new reporting period - but we refresh the entire model with the full set of newly available information, automatically capturing any historical restatements and identifying them to our clients. Thus our historical credit metrics immediately reflect any restated numbers and are as accurate a portrayal as possible of an issuer’s true credit profile.

An example of restated financial statements

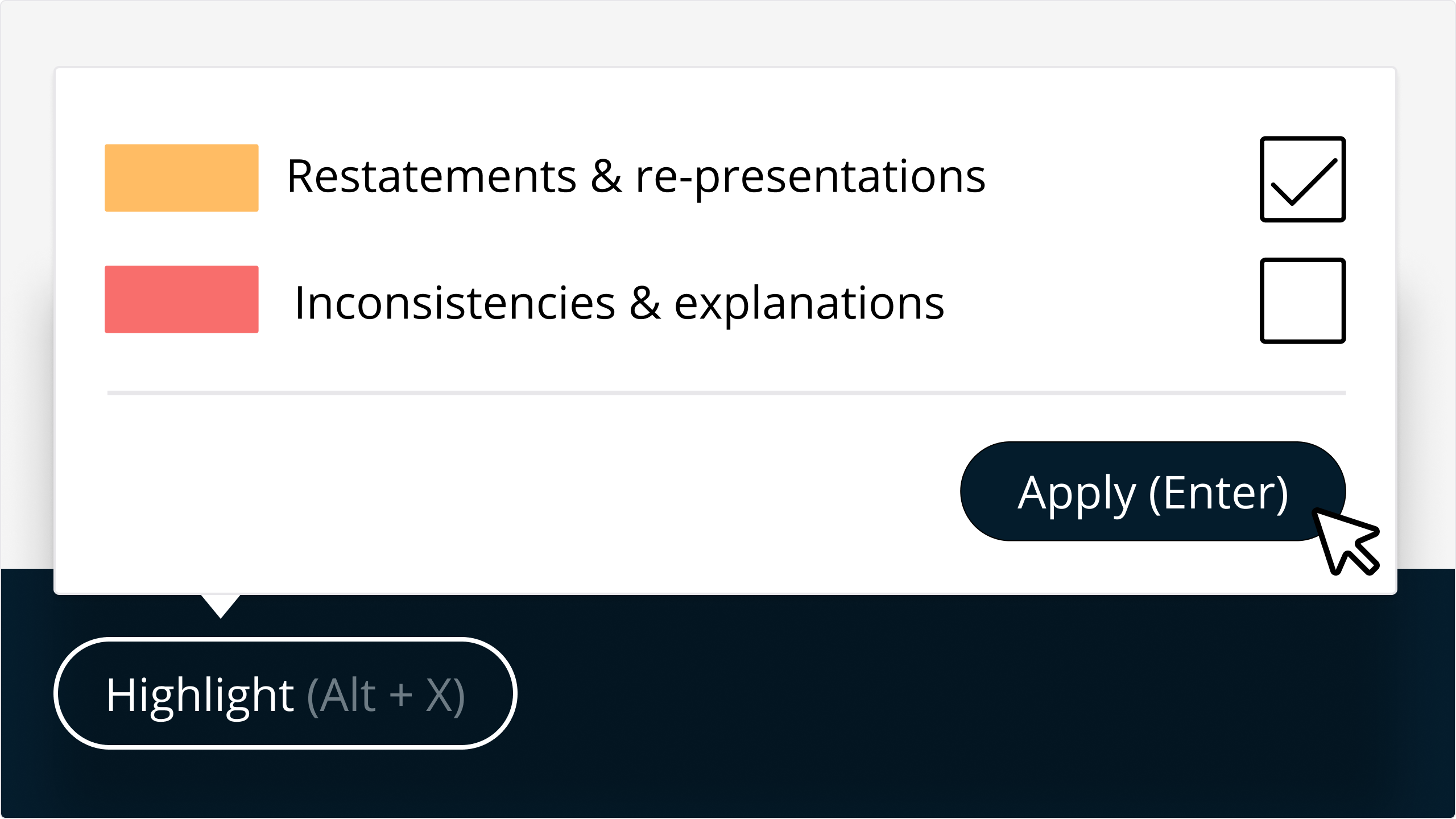

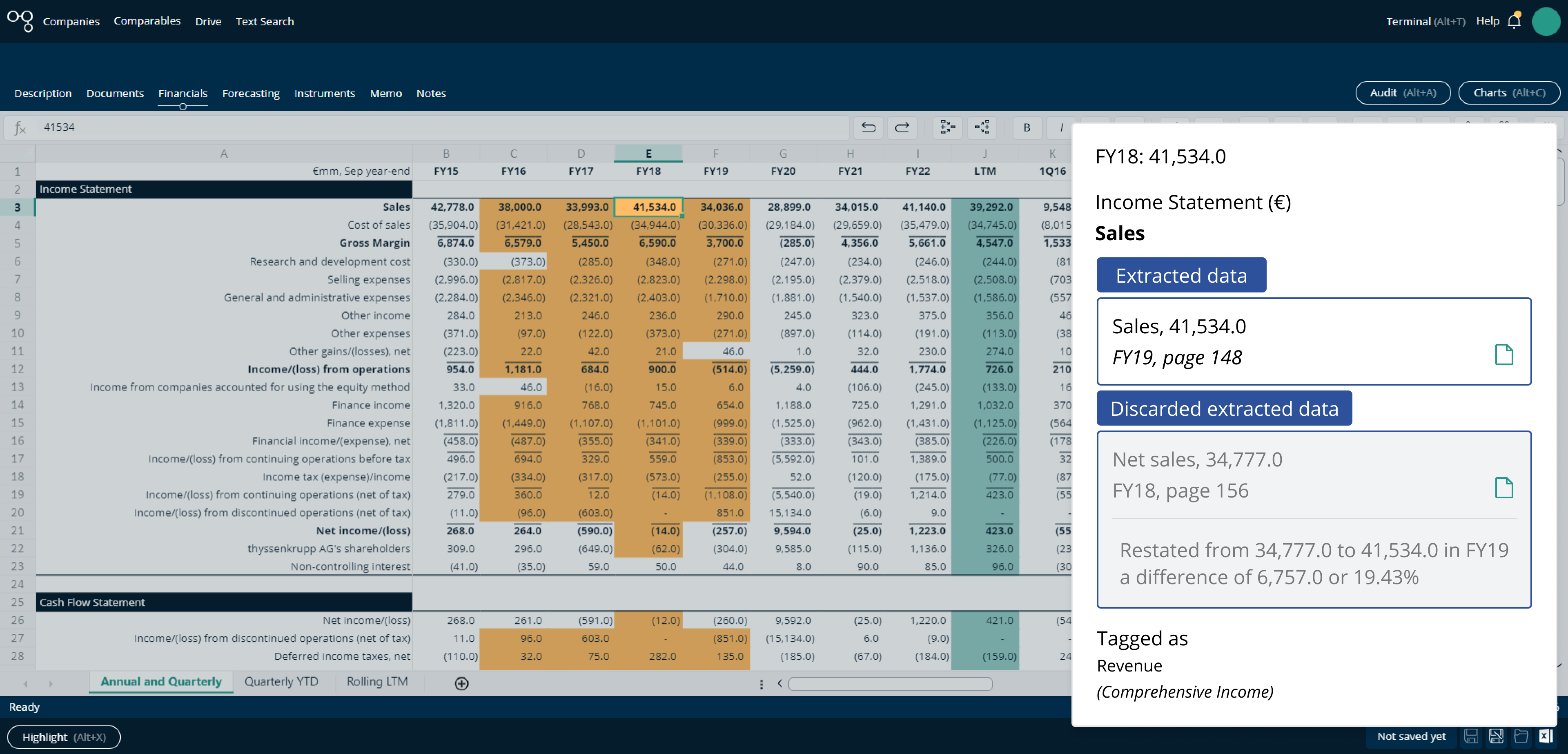

At Cognitive Credit, we highlight financial restatements via our audit panel. Available exclusively via our web application, the audit panel provides users with indications of the materiality of restatements, and of course allows click-through to both pre- and post-restated source financial reports.

In the example below, the company restated its FY18 sales value in its FY19 Income Statement. Our extraction technology identified this change when extracting the restated document, discarded the original value and noted the difference - all of which is noted in the Audit Panel.

As best practice, we always recommend users “toggle on” restatements in a model when looking at a new name for the first time to confirm how consistent the company’s reporting has been historically and check if there are any accounting games being played in past disclosure.

Full transparency for faster credit analysis

With Cognitive Credit, you’ll never need to worry about the manual fallout of a financial restatement again. You’ll always have the latest reported view of a company in an up-to-date credit model, with restatements clearly highlighted via our audit panel. It’s just one of the many ways our technology facilitates more efficient, insightful credit analysis among our clients.

To see it all in action, request your demo of our web application today.

This post features contributions from Jack Wearne.