Despite the vast array of third-party market commentary and research services available in credit markets, forming your own credit view remains a time-consuming and manual task. Here, we outline some of the challenges in this process, and suggest how applying technology leads to a better solution.

Forming a Credit View: The Challenge

Whether it’s a name suddenly topical across the market, a portfolio manager impatiently asking for an opinion or a client eager to debate an investment thesis, getting up to speed on a credit situation requires a significant amount of quantitative and qualitative preparation to form even a high-level view.

Forming a credit view is easy - an analyst need look no further than the plethora of third-party market commentary and research services across financial markets.

Forming your own credit view is challenging. While the gains from original perspectives on the market can be very rewarding, the process of arriving at unique insights is time-intensive and expensive. To do it quickly enough to respond to fast-moving markets is especially difficult.

Your Own Credit View: Why it Matters

Forming a view on a name ultimately means answering the question, ‘am I being compensated for the risk I’m taking’? In other words, does the company in question generate sufficient cash flow to repay their debts, are these debts priced correctly as a function of yield, and finally if the situation does not unfold as initially envisaged, what is the recoverable value, commonly referred to as ‘downside protection’.

Forming “your own view” implies an analyst is able to form coherent answers to these questions distinct from how others perceive the same situation. In an increasingly crowded market, both from the perspective of the number of market participants and opinions proffered, a unique view is of paramount importance.

It’s not the case that every investor or investment need be contrarian, but if an investor does not form their own view, it is impossible to discern whether the observed market price is a correct reflection of risk or simply the entire market repeating an incorrect view.

Furthermore, the ability to form their own view faster means the analyst is best positioned to take advantage of discrepancies between the market perception of risk and the true value of risk, before this gap is closed.

Your Own Credit View: The Requirements

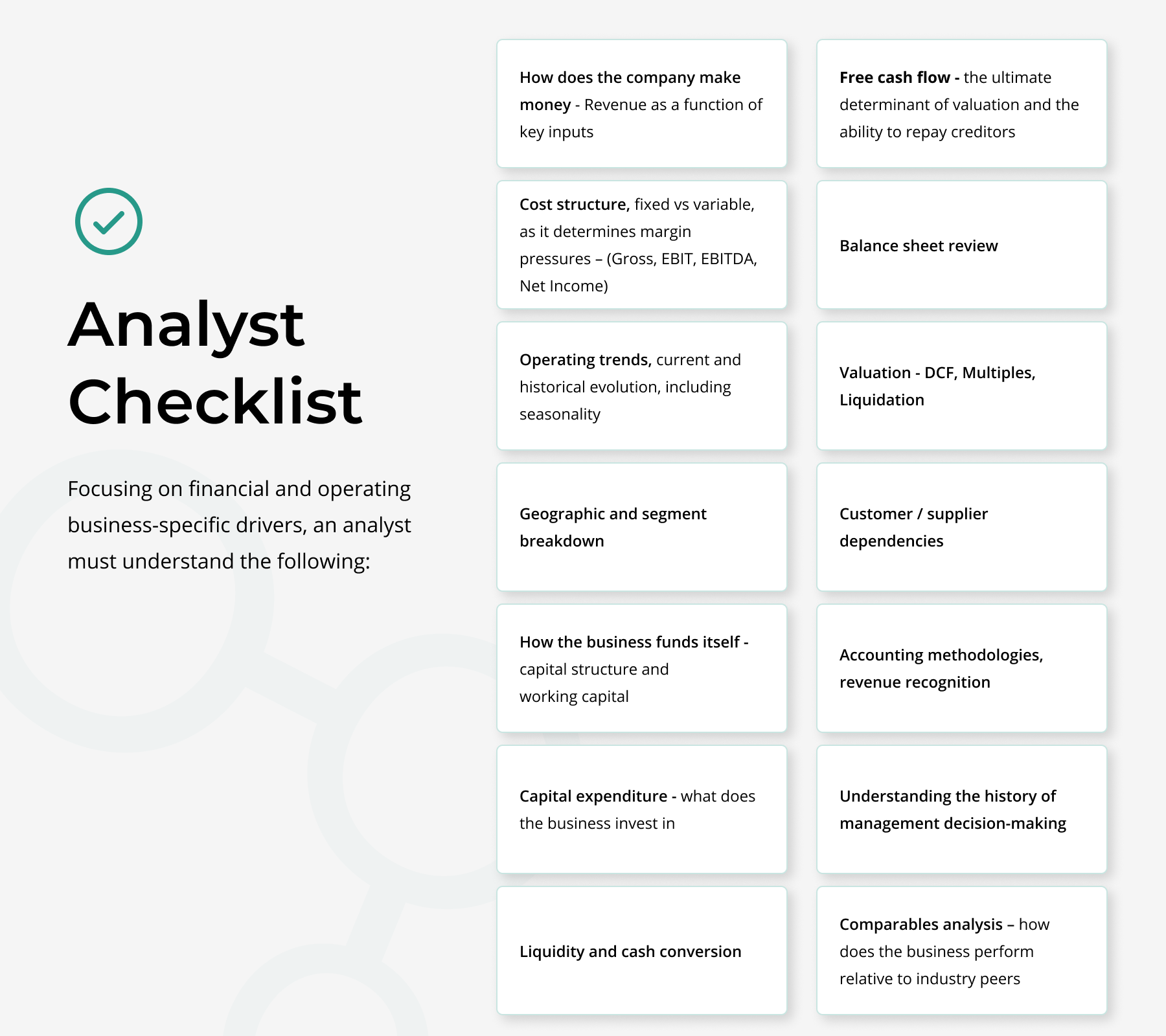

The path to forming a view traverses a long list of both quantitative and qualitative questions. The list can be broadly grouped into the following categories: business, industry, legal (jurisdiction, operating entities, intercompany relationships, documentation) and macroeconomic.

Based on the above list, it becomes readily apparent that the analyst must possess a financial model robust enough to form an initial view, most often to simply decide whether the name ‘requires more work’.

The credit model, a historic look at company reported financials over a sufficient time frame, combined with the ability to forecast expected future financial performance under various scenarios, is the foundation on which the answers to the above questions are based. The model by itself is not sufficient to answer all of the enumerated checklist, but without it, initiating the process of forming a view is impossible.

Manually building one credit model to form this initial view is an expensive use of time, especially if the outcome is an idea not worth pursuing – the case where market price sufficiently reflects the credit risk in question.

As seen below, manually building a credit model is one of the slower, more mundane and repetitive tasks in the investment process. If the goal of the credit analyst is to form their own view as quickly as possible, credit model building is the area of credit analysis that stands to benefit the most from well-applied technology.

The Current Way: A Manual Process

The manual process at a minimum entails collating financial statement pdfs (are the reports behind a private site firewall? where does IR hide the presentations?), determining the appropriate amount of historical data required to form a sufficient sample size (do 8 quarters determine a working capital cycle?), and then laying out the requisite number of PDFs across one screen, Excel spread across two more.

Only then does an analyst initiate the even more laborious process of manually entering numbers into a spreadsheet (what to do when FY 21’s ending cash balance doesn’t match the starting cash balance in the 1, 2 or 3Q22s? How to account for the restatement of annual figures when interim periods are not? How to handle the removal and addition of reported line items over time?). And all of this before deciding which credit metrics are worth calculating and over what period - Annual, quarterly, last-twelve months, ie LTMs?

For example, why is it the case that LTM EBITDA is generally the only LTM figure viewed in most manually built financial models? Almost certainly because it’s the one required to calculate a leverage figure. But do LTM figures across the Income Statement and Cash Flow not provide useful indications of historical performance - especially when charted visually. Perhaps they do but when considering the time spent on the additional calculations vs the benefit derived, these line items generally do not make it off the cutting room floor.

If an analyst has already spent 3-6 hours spreading numbers and is already compromising on the quality of historical backfill, is it worth spending time building out an LTM view for all line items across main financial statements, operating notes and credit metrics?

The entire process, it turns out, is a big cost-benefit analysis of time spent versus insight derived, yet another risk vs reward calculation.

On one hand, the opportunity cost of spending time on the wrong investment can be prohibitively expensive. Build too intricate a model only to determine the situation is not interesting – price is correct – and the analyst has lost a day. However, the alternative, a rushed model - price was correct, your view was not - is hardly preferable.

Given the above, it’s no wonder any credit analyst who has spent more than 6 months in the job has at some point contemplated the idea that ‘there must be a better way’.

Designing a Better Way: Technology Applied to Credit Markets

If a better way did exist, what would it look like?

For starters, the repetition of collating documents and manually entering numbers into spreadsheets would be a thing of the past. The analyst would have access to a complete repository of models and financial reports including presentations across global credit markets. All data would be filterable and sortable from a top-down view to highlight potential investment ideas. All documents would be indexed and searchable for key thematic investment themes.

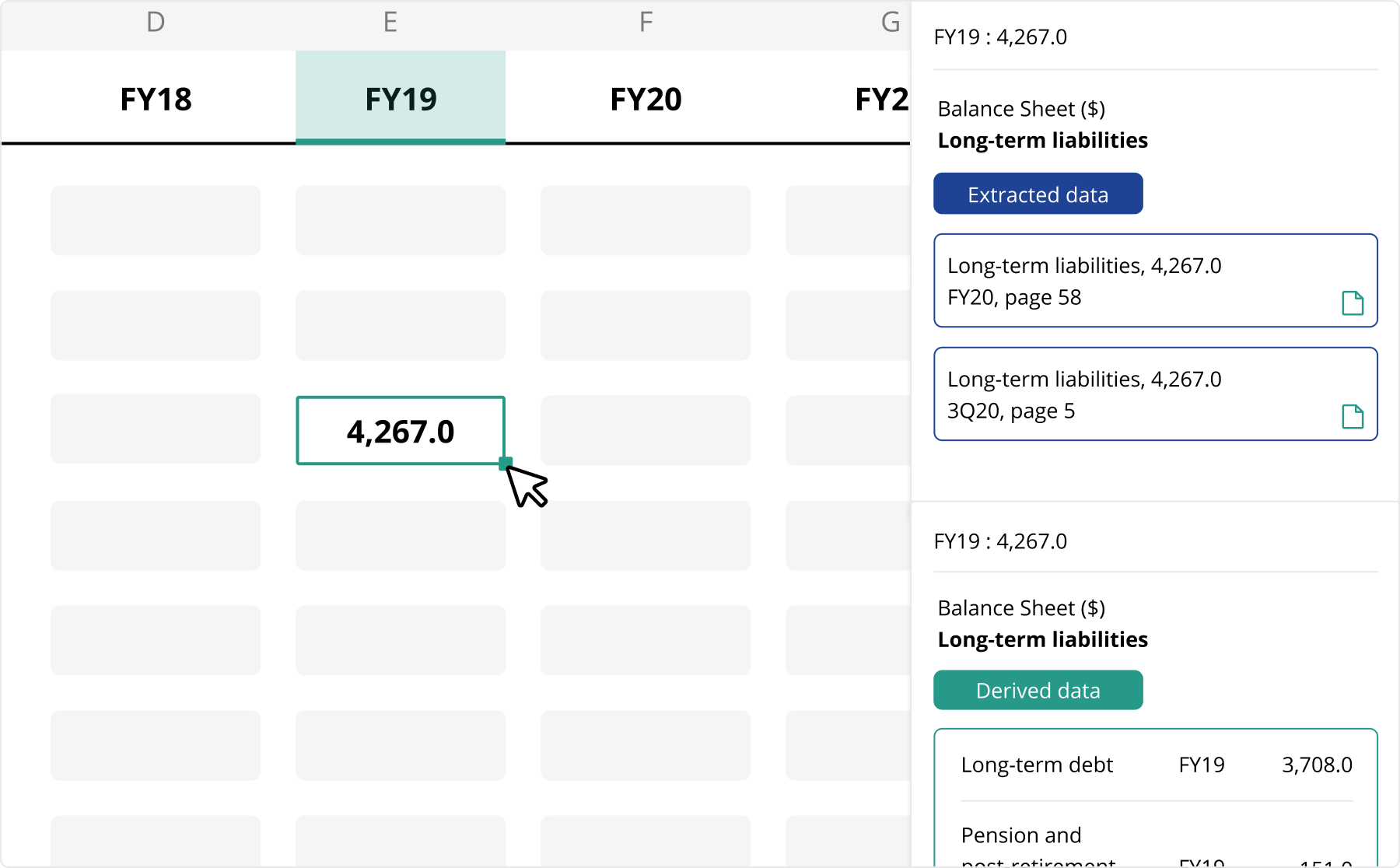

The ability to use such a tool would be predicated on a fundamental trust in the data and the ability to seamlessly tie numbers back to original source documents.

The backfilled historical data would render moot any questions about a sufficiently large sample size to draw satisfactory conclusions.

No requirement would exist to decide which credit metrics to include over what period view because all relevant ones would already be included, inclusive of LTM calculations. Furthermore any missing credit metrics could be easily calculated and saved for permanent viewing on a going forward basis.

To that end all of these models would be automatically updated and maintained for new earnings reports, greatly minimizing the need to do any manual updates each quarter.

And all of it would be completed as quickly and accurately as possible.

The time saved building credit models would be better applied to the deep dive work a human analyst currently performs better than computers - reading financial notes and legal documentation or speaking to management and other experts in the industry. Conservatively assuming 10+ hours per week spent building financial models implies 2+ months of newfound analyst capacity every year.

Fortunately, a better way does exist. As discussed in our previous piece about ‘Technology vs Offshoring’, the application of technology to credit markets has sorely lagged the rest of financial markets.

The challenges laid out above - collating reports, extracting information from financial statement PDFs, accurately classifying financial statement tables, capturing and identifying financial statement data points and performing calculations to both verify company reported information and derive required credit metrics in a structured and repeatable process - are exactly where technology is best applied.

Cognitive Credit: An Integrated Solution for Credit Investors

Cognitive Credit does all of the above and much more.

Cognitive Credit helps eliminate the time spent on manually building and updating credit models by providing access to over 1,500 issuer credit models - and their corresponding credit metrics - in an easily digestible format across 4 coverage universes (US HY, EU HY, US IG, EU IG).

From a bottoms-up approach Cognitive Credit allows the analyst to form their own view, faster - searchable financial reports stored in one centralized location, a robust credit model with easily accessible visualization tools that highlight historical patterns worth investigating. A forecasting tool that allows an analyst to build and save scenario analyses, automatically updated for new earnings to track analyst expectations versus new financial results.

From a top-down approach, Cognitive Credit has captured over 10 million data points spanning global credit markets inclusive of both fundamental and market data. This allows the analyst to set any number of filters to surface insights worth exploring across both individual companies and entire sectors.

By leveraging the latest in a suite of technologies to eliminate redundant, slow and manual processes, Cognitive Credit empowers credit analysts to form their own view, faster.

Want to See Our Technology in Action?

If you’re interested in discovering how technology can transform your credit modeling process - and help you cover even more credits - get in touch today.

.png)