4 months on from our original analysis, we take another look at bond market volatility to see what single name opportunities have emerged.

In our blog post from August 2023, “There’s always something going on in credit markets”, we identified that bond price volatility is a fact of the market and anyone who claims there is “nothing going on” is just wrong.

In that piece, we also highlighted something more interesting - volatility begets volatility. Once a bond has made a significant price move in a short period of time, it is more likely to make that kind of move again. For this follow-up, we ran the numbers to the end of October to identify the companies that experienced volatility.

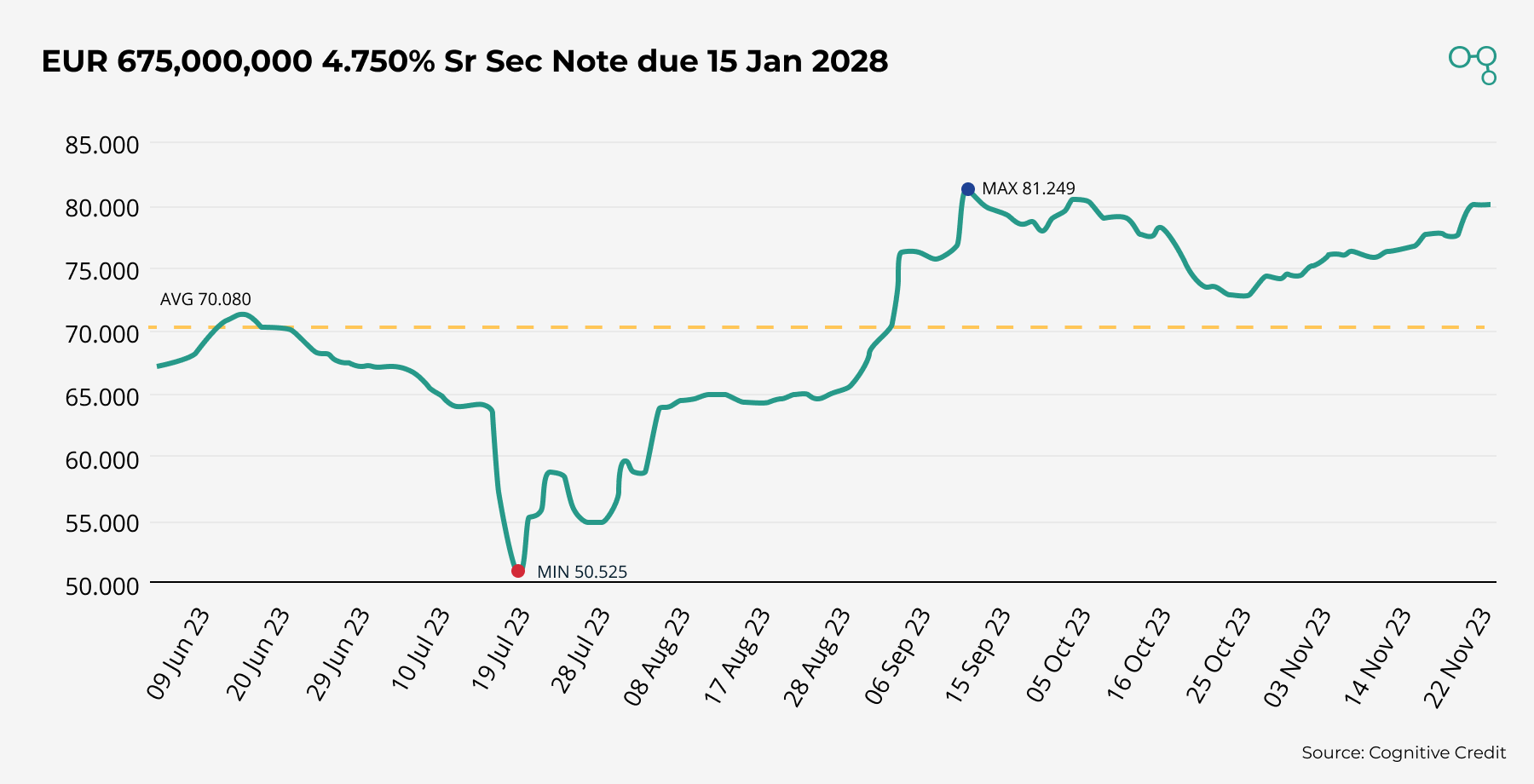

Volatility and opportunity: The Altice example

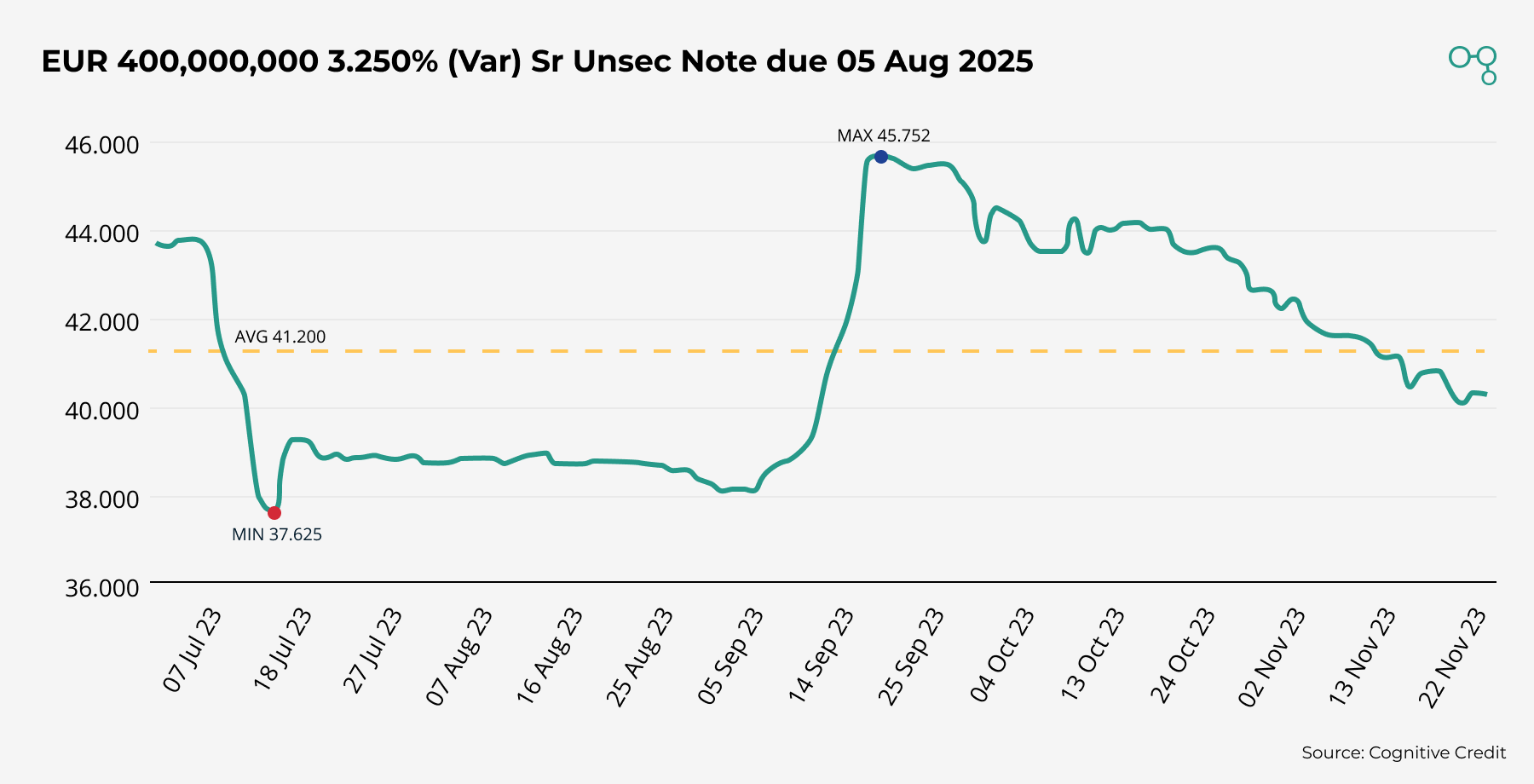

Over the past few months, the Altice structure has been the most-viewed group of companies on our app, and for good reason - it’s a huge opportunity for credit investors:

- Debt stack >$50 billion across International, USA and France

- Bond prices across the structure ranging from the 30s to the 90s

- On-going bond price volatility

Since the start of June, Altice International bonds have moved (in aggregate) over 60 points - down, up, down and up again. That’s plenty of volatility - and opportunity - for investors to capitalize on.

At this point, most people already have a view on Altice. But if volatility is an indicator of future opportunity, we asked ourselves: what other names should everyone be looking at?

Corporate Bond Market Volatility: November 2023

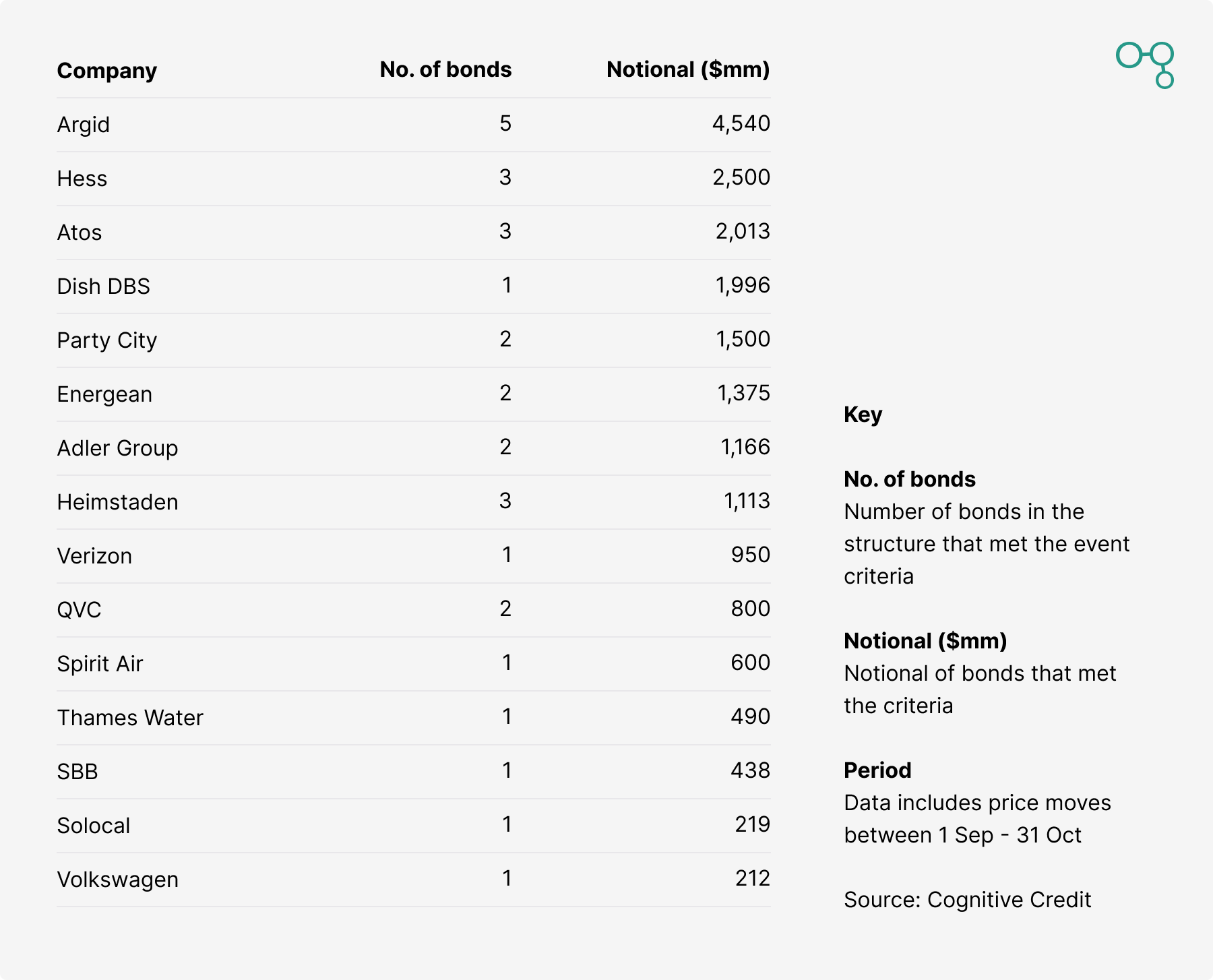

For the purpose of this analysis, we used a 7 point hurdle. If a bond moved through a 7 point range over the previous 5 closes, that would be classified as an event. All data used is available via our web application in partnership with S&P Global.

Here’s the list of companies:

Not every one of these opportunities will interest every type of investor, the opportunity set is quite diverse. We’ve picked out a few of the names and added some additional insight from the analytics available in our web application below.

Special situations

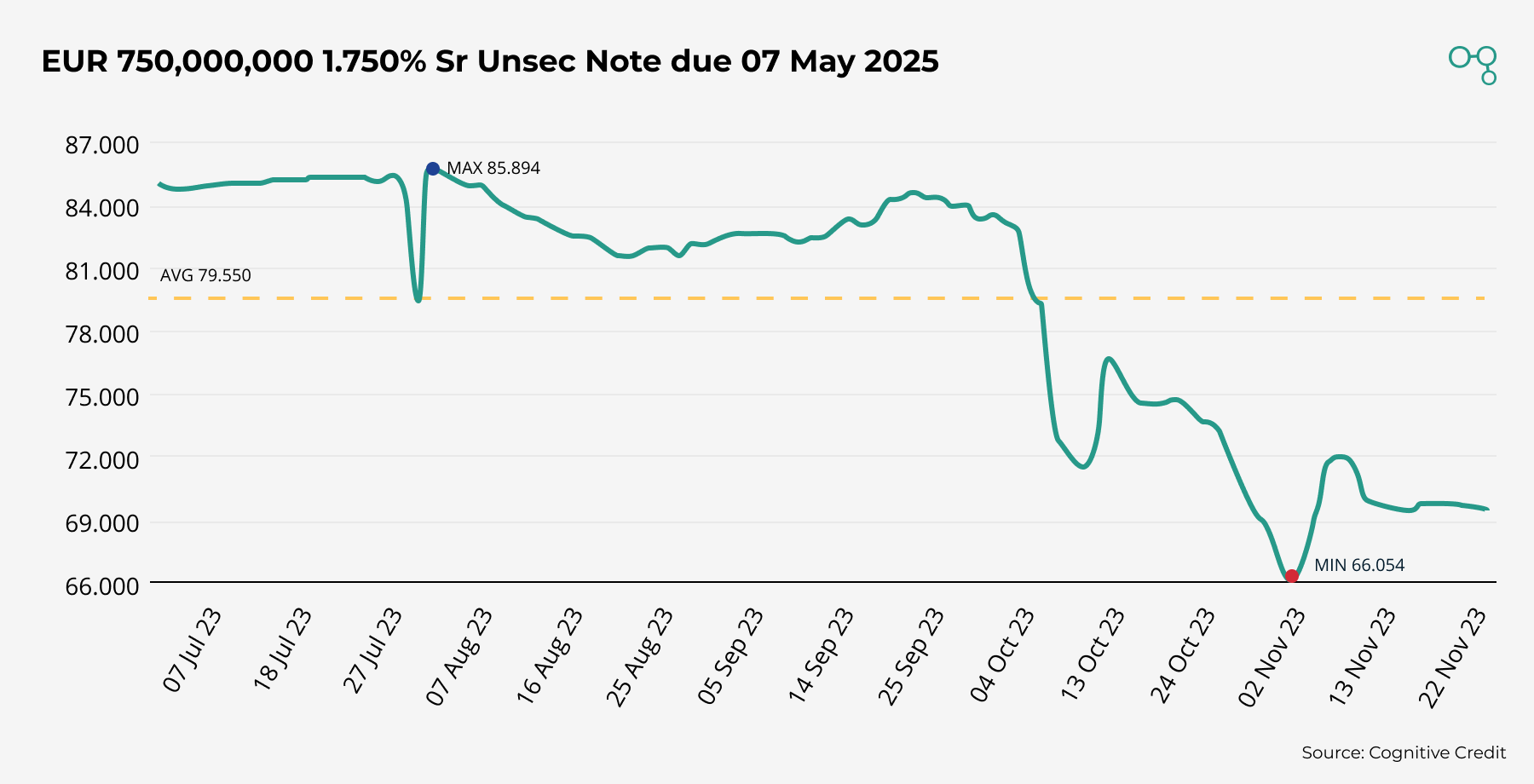

New

There are some brand new situations that many credit investors won’t have spent much time on before: until June this year, Atos traded like the BB rated company that it was - but not anymore:

This is a €2.5 billion cap structure, with a €500 million convert maturing in under a year and a €750 million bond due within 18 months - exactly the kind of name you need to have a view on.

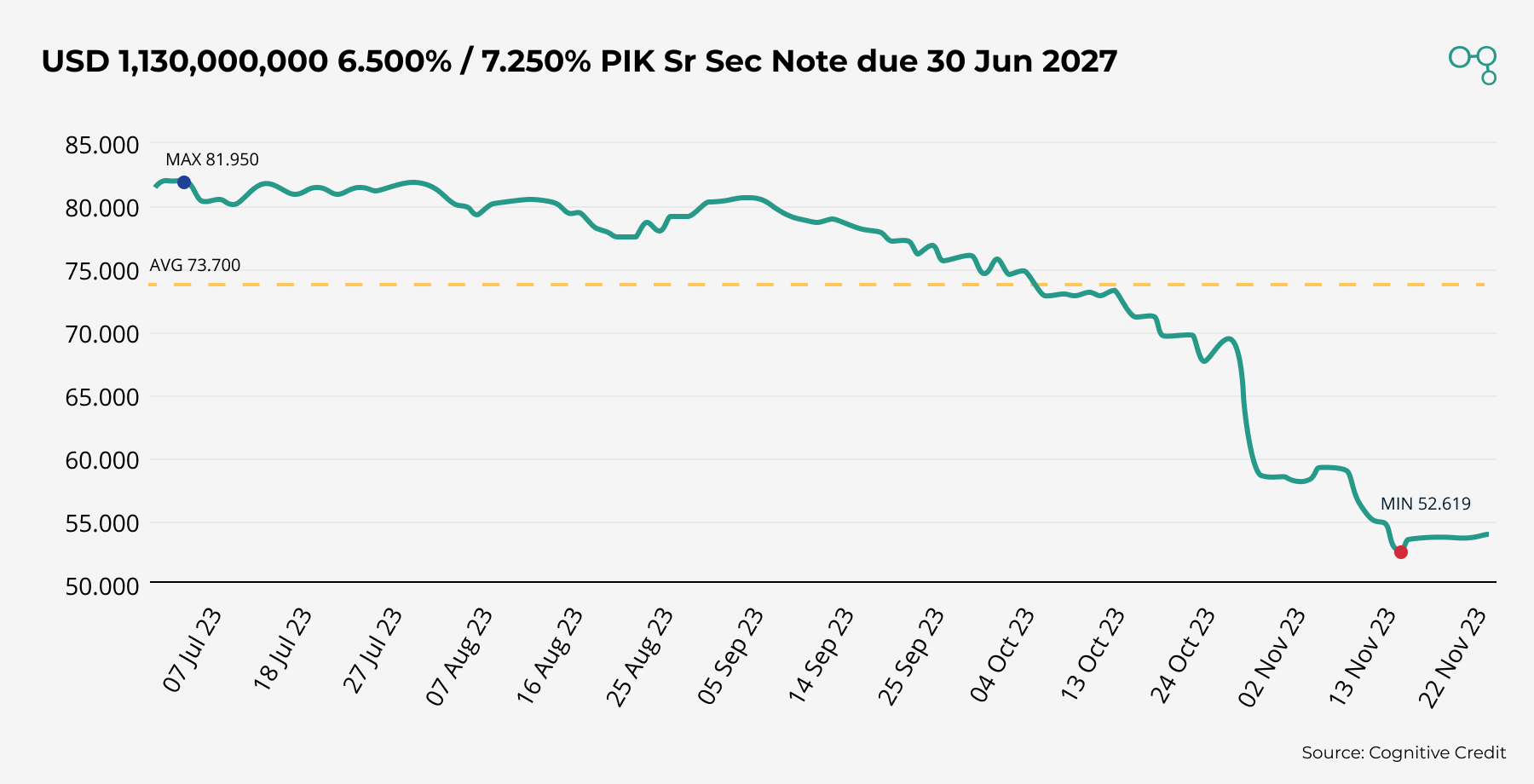

Returning

And then, there is the return of some well known bonds and companies after an absence of a few years: Argid triggering an event at the end of October following their most recent earnings report. It wasn’t just the PIKS, $4.55 billion of bonds in the structure triggered an event.

Ongoing

There are situations that have been volatile for months, if not years: Adler Group has been triggering price move events for over 2 years now, and did so again in the last 3 months.

Distressed

Solocal bonds are trading in the 20s and the party city bonds are trading in the single digits.

Idiosyncratic

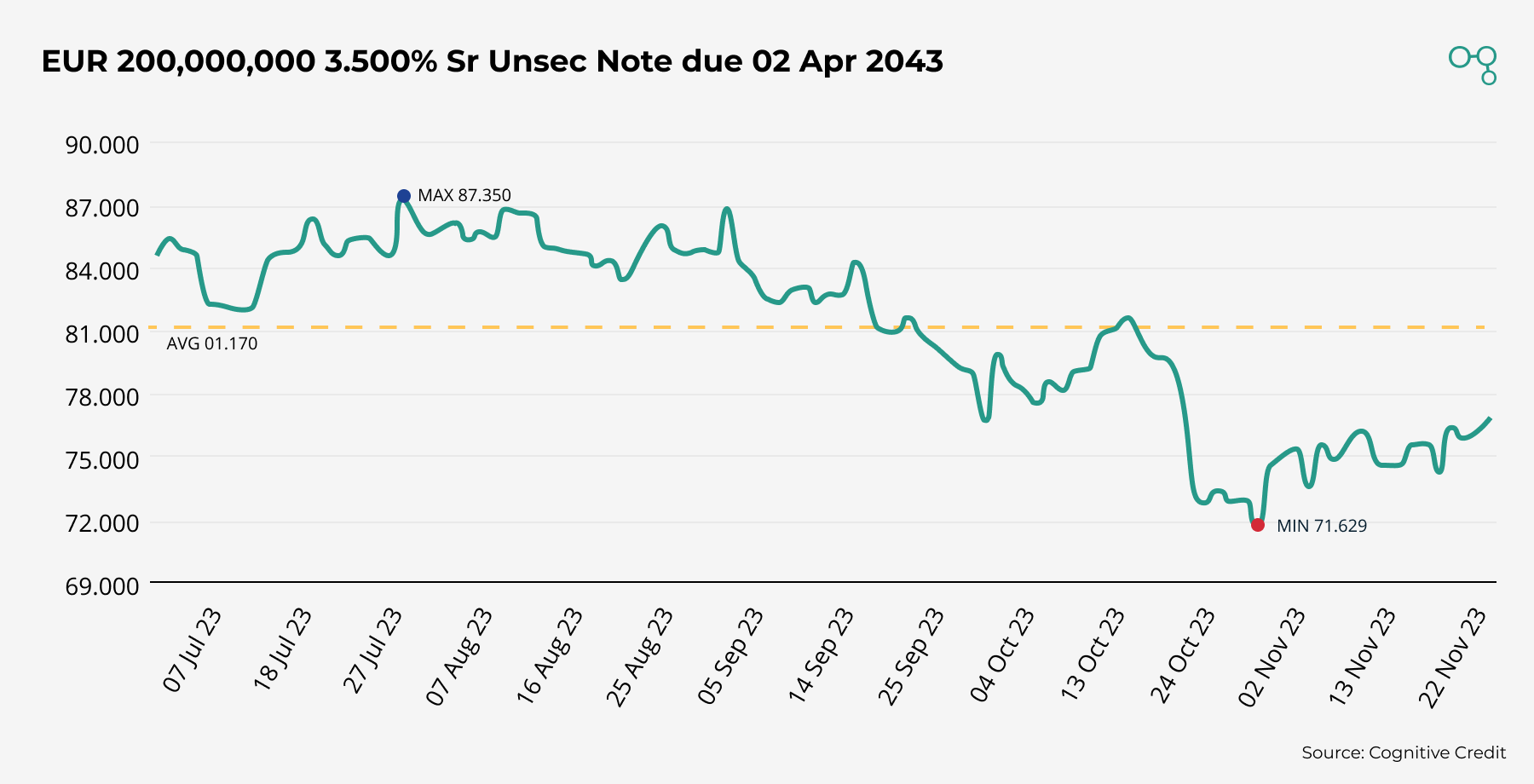

There are also some smaller sized (albeit of big companies) idiosyncratic bond opportunities: the Volkswagen 3.5% 2043 is only a EUR200mm issue, but has exhibited significant volatility both in price and yield terms:

Why do price moves matter?

Why look at price moves that have already happened? Because, as we discovered in our original post, with volatility comes opportunity. A bond that triggers an event is 20x more likely to appear on our Volatility list again than a bond in our coverage universe that hasn’t.

With Cognitive Credit, you can conveniently track market volatility and stay current on as many names as you need. With ready-to-use, fully customizable financials, you can form your own view quickly and easily maintain it with instant earnings updates. And with built-in analytics, you can interrogate every metric, financial statement and instrument to enhance your understanding of an is

To try it for yourself, request your demo today.