KPIs provide credit analysts with valuable insight into the operational health of a company. Here’s how you can access them on our application.

This week, we’re pleased to announce the addition of operational KPIs to Cognitive Credit.

Long requested by our clients, KPIs are now available via the Financials in our web application, and can be streamed directly into your business systems via our API. Over the course of 2023, we’ve been adding KPIs to our existing coverage universes where available – and we’ll continue to do so on an ongoing basis, sector by sector.

With the addition of KPIs to our financial models, our data sets now offer all the fundamental data and operational insight credit investors need for deeper credit analysis – in one convenient place. In this blog, we’ll cover everything you need to know about this new addition: what are operational KPIs, how we source them and how to access them.

The importance of KPIs in credit analysis

In any business, operational KPIs are metrics used to measure performance against an agreed set of objectives. In credit analysis, these metrics provide deeper insights into the day-to-day operational efficiency of a company. For example:

- If we can understand how inflationary pressures are affecting the number of subscribers to a telecom provider’s services, or their average revenue per user, we can really start to understand what’s going on with the business and why changes in revenue occurred and/or how earnings and free cash flow might evolve in future periods.

- If we know that a mining company is starting to mine seams with a lower ore grade, we can start to evaluate how its cost per ton might develop adversely over time.

These are the sorts of underlying business developments that drive future financial performance, but also underpin the longer-term investment case for the company’s bonds.

By understanding KPIs and the drivers behind them, credit analysts are able to generate a much richer level of knowledge about current and potential investments. And the more granular that information is, the more accurate an analyst’s scenario analysis, performance forecasts, valuations and investment recommendations will be.

How do we obtain KPI data?

As with all the fundamental data contained within our credit models, we source operational KPIs directly from publicly available documents - Preliminary Reports, Financial Reports and Prospectuses. You can find out more about how we extract and process that data in our related post on how our technology makes financial data extraction easier.

At Cognitive Credit, data integrity is paramount. That’s why our innovative web application includes a built-in data audit feature to trace every published value back to the source document from which it was extracted. This enables you to find instantly the specific page where a value was originally reported and access clear explanations for any additional derived data - so you can always be certain about the origin of the data in our models.

How to access KPIs on Cognitive Credit

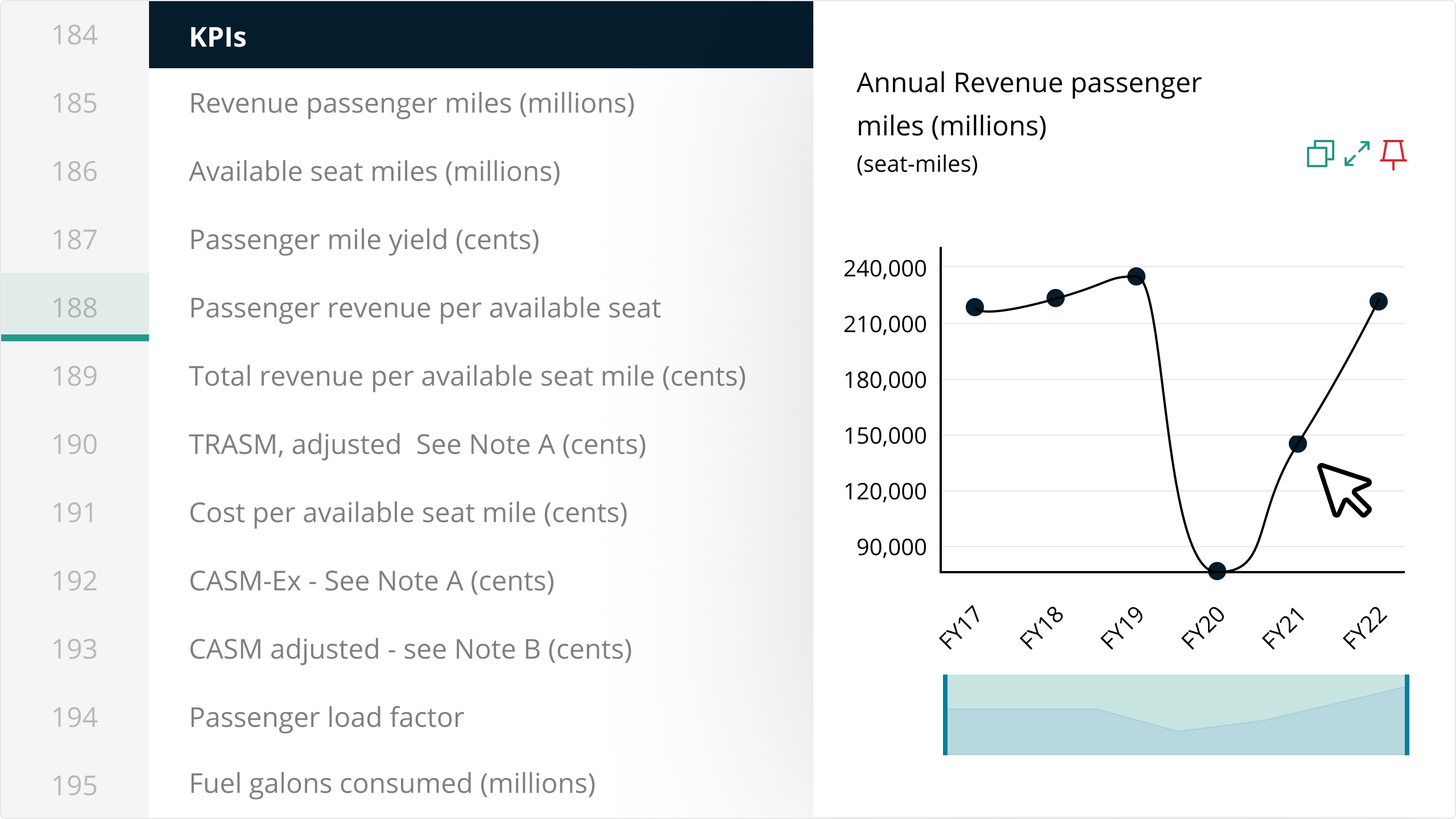

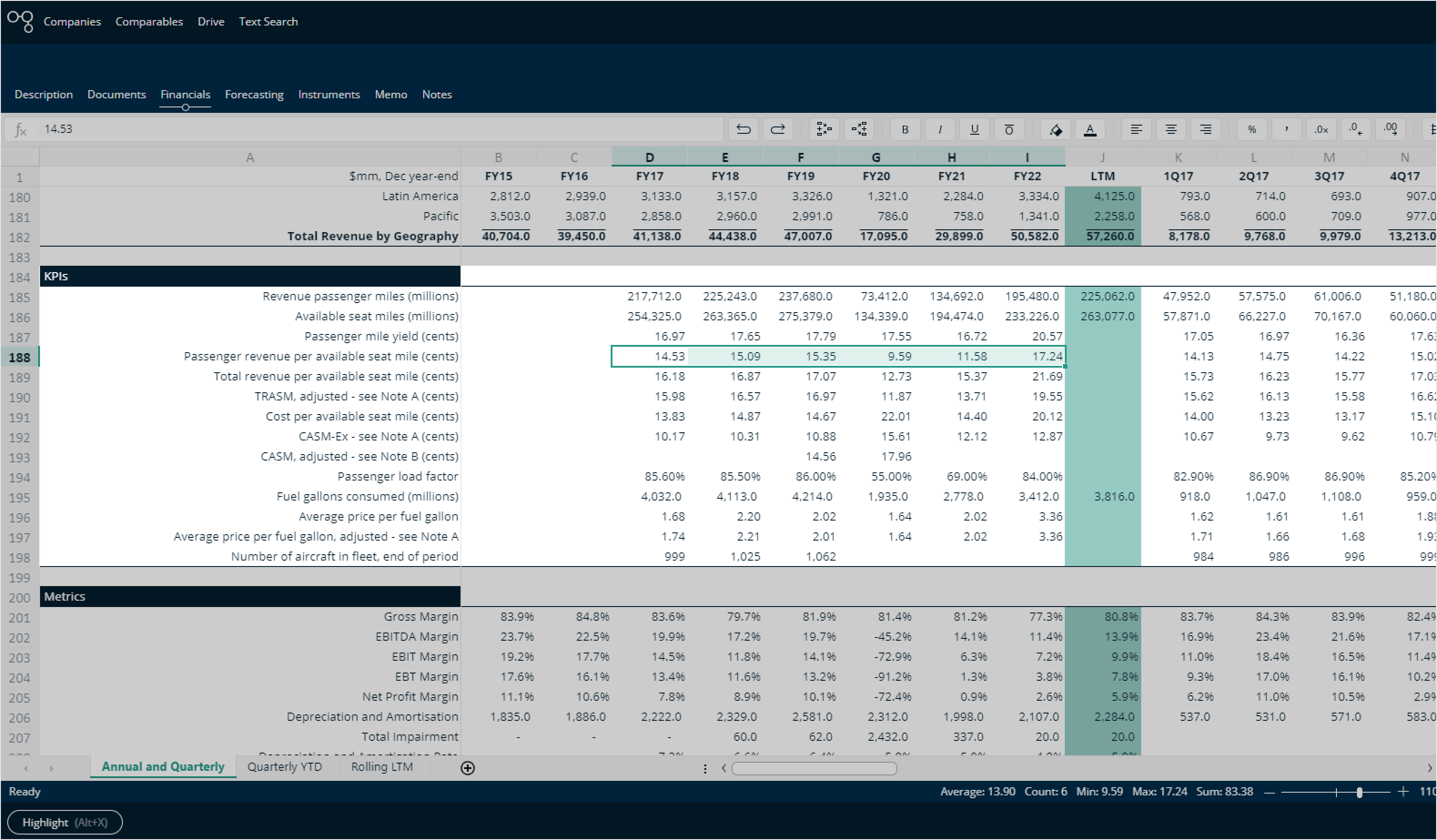

To access operational KPIs in our web application, simply navigate to the Financials page on any issuer, and then scroll vertically to reach the KPIs section shown below. Additionally, you can jump straight to the KPIs section of our credit models by using the Search (Ctrl + F) feature and entering ‘KPIs’.

If you’re looking for KPIs to be streamed directly into your quantitative analysis workflow, contact us today about API integration.

Deeper data for your credit analysis

With the addition of operational KPIs to Cognitive Credit, we’re delivering on our goal of providing the market’s most comprehensive fundamental data sets, easily and conveniently. By leveraging the data extracted by our technology, you’ll be able to scale up your market coverage and get up to speed faster on more credits. And by incorporating our KPIs data into your analysis, you can deepen your understanding of an issuer and enhance your investment decision-making process.

To access our KPI data, simply request your demo today.