In addition to all the main financial statements, Cognitive Credit also includes preliminary reporting in our credit data, enabling us to deliver a more timely and complete picture of a name.

Cognitive Credit was built by credit analysts, for credit analysts, and our team has an extensive background covering companies in traditional sell side and buy side roles. On the back of this experience, we fully understand the challenge of digesting market-moving information in a timely manner across a wide number of credits.

We also recognize that one of the keys to covering the credit market successfully is capturing information not just from formal financial reports, but also from less standardized preliminary reports.

What are Preliminary Financial Statements?

Preliminary financial statements provide an early snapshot of a company's financial performance for the latest period. The format, timing, and specific contents of these “prelims” differs from company to company. Information contained within can range from full financial statements to abbreviated non-GAAP or IFRS disclosures, such as EBITDA, leverage and KPIs to name a few.

Cognitive Credit is uniquely set up to scrape these preliminary reports and present the available information as a real-time model update. This “first look” allows credit analysts to begin forming a view on a name ahead of the full earnings release.

Why process Preliminary Financial Statements?

There are several reasons why the inclusion of preliminary reports is critical to the value we provide our clients.

First is timeliness. The vast majority of US companies initially disseminate quarterly earnings as a press release and then - within 4 days - as an SEC form 8-K. This can be well in advance of the 10-Q or 10-K SEC filing: the time gap between the preliminary and full financial report varies, and can be as long as 30-45 days. Solely relying on official financial reports would imply missing incremental, market-moving information.

The next advantage is that of capturing non-GAAP or IFRS information critical to credit analysis. Concepts such as EBITDA, leverage, free cash flow, segment breakdowns and KPIs are often disclosed exclusively in preliminary reports.

Finally, we post preliminaries to our Documents page just after they are published by the company, giving analysts all available qualitative commentary at their fingertips. This information often summarizes the most important elements of financial performance in the period.

How do we display Preliminary reporting data?

Preliminary financial data is clearly identified in both our web application and emailed alerts. Whenever Prelim reporting is published1, our real-time email alerts will always display a “Prelim” label in the subject line to avoid any confusion:

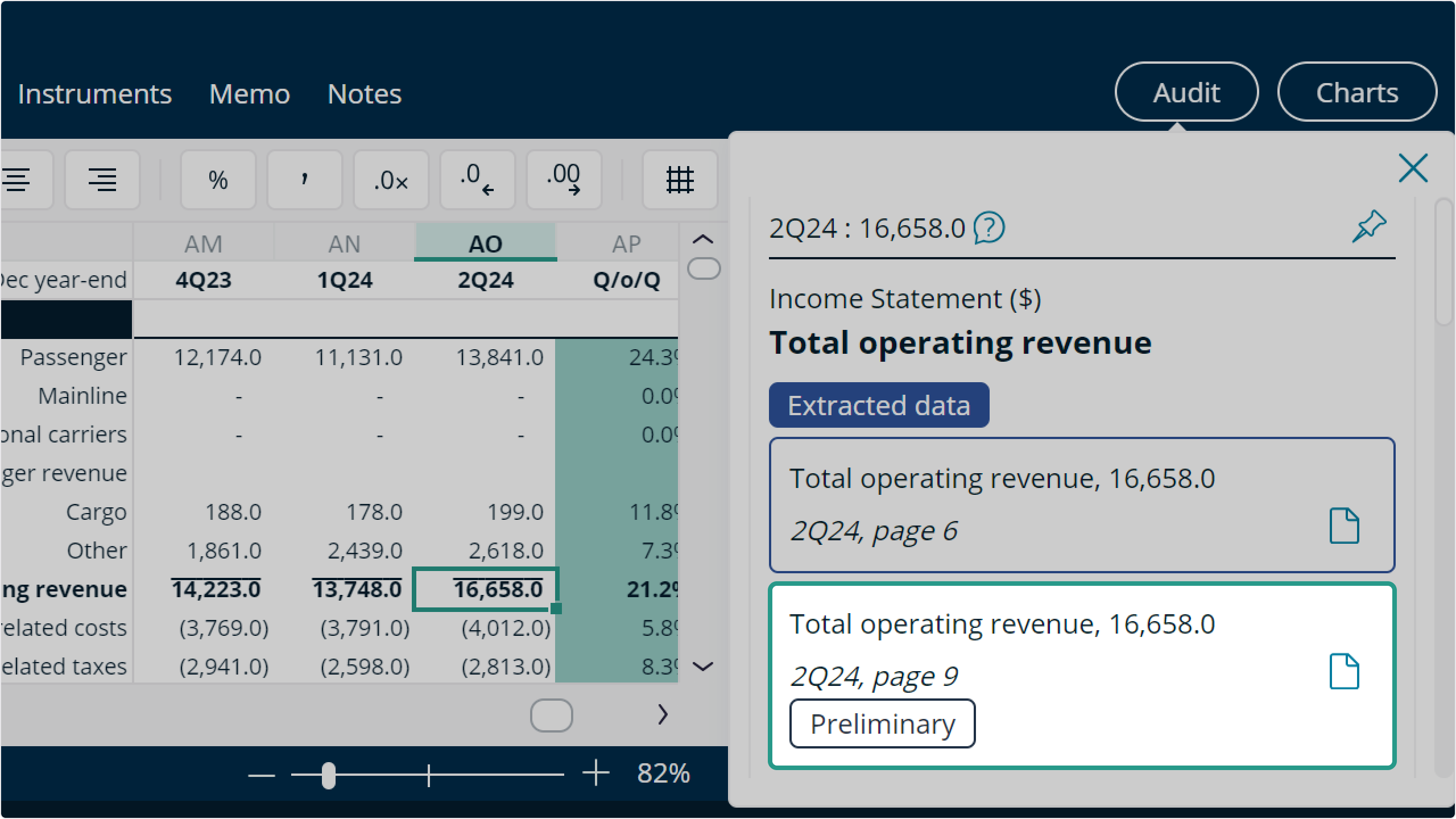

Additionally, when viewing preliminary data in a credit model via the application, the Audit panel clearly labels the source document type as Preliminary:

Fast, accurate and comprehensive credit data

Capturing incremental, accurate data in real time is the cornerstone of what we do for our clients, and preliminary data plays a key part in fulfilling that mission.

All our fundamental data – including preliminary and actual reporting – is available in our web application. Through proprietary technology, we update and publish our credit models within 15 minutes of earnings release and give you the analytical tools you need to form your own view, faster.

To try it for yourself, sign up for complimentary access today.

1 Conditional on an issuer providing a minimal set of financial data – namely an Income Statement and leverage.