Modeling remains a staple of credit analysis. But we argue that the value of modeling lies as much within the process as it does the outcome - and that abundance of quality data is always key.

Upon arriving at a credit research desk, it’s not uncommon for new analysts to be given the tasks of building company models and preparing initial forecasts. But why do we want young analysts to spend so much time preparing these numbers - to give them something to do? Because the Senior Analyst did it twenty years ago?

At this point, one of the most common questions a Senior Analyst will get asked is “How do I model? Where do the forecasts come from?” Expecting some kind of mathematical formula-based answer, the expression on the face of this quantitatively-literate, intelligent young analyst then drops as it is explained that modeling is often as much an art as a science. That company-level models don’t necessarily have complicated macros running based on multi-factor correlations to economic indicators in order to predict with 95% confidence a multinational’s quarterly EBITDA down to several decimal points of precision.

Well - maybe yours do, mine never did!

The growth of quantitative analysis has been at a top-down market level, rather than at the level of specific credits. Because no matter how scientific an approach you take, every credit analyst soon learns that the modeling just ‘doesn't work like that’ - as the real world is always more complicated than we can calculate. Building more detailed models, informed by our qualitative analysis, provides us with more confidence in our forecasts, however the correlations to investment outcomes may still remain frustratingly elusive on many occasions.

So, given that we know through experience that our forecasts of company performance are as likely to be as often wrong as right, why do we bother modeling (and why do we teach those young analysts to model?)

Modeling is less about the outcome and more about the process

As discussed in our previous post on forming your own credit view, the act of building a model is a fundamental prerequisite to forming our own credit view on a name. Whilst analysts may differ in their view of the risks associated with a particular credit, at some point they must crunch the numbers to come up with an expected pathway for the company in terms of cashflow, leverage and liquidity.

Depending on the level of importance (or Tiering) of a particular company within an analyst’s coverage responsibilities, the model may be fairly rudimentary, or incredibly detailed, but the importance of the modeling process is that the insights it provides helps the analyst to improve their knowledge and understanding of the company, and the related investment opportunities. The value is less that you estimate 2Q23 EBITDA growth to be 4.5%, and more about what you learned whilst refining that forecast.

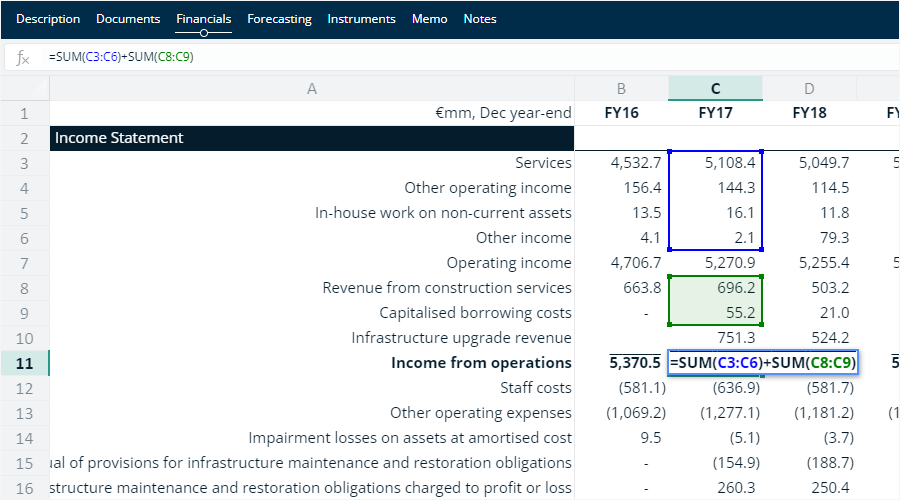

Image: A standard credit model as feature in the Cognitive Credit web application

Maintenance modeling

For those credits which are nominally within our coverage responsibilities, but which aren’t deemed as focused opportunities (we refer to this as the Tier 3 cohort), our modeling will probably be pretty basic. Sometimes it can resemble a box-ticking exercise - we know we should have a model on all the companies, but our resources within an ever larger credit investment universe are stretched too thinly to really do a thorough analysis.

However whilst often simplistic, Maintenance Models are still useful - firstly to provide a general background for a market or industry with regard to what a credit “should” look like such as “BB-rated packaging companies leverage should be around 1-2x, and they should be seeing margin growth this quarter”. This helps inform expectations around the relative value of more interesting credits we are focusing on.

Even more importantly, any model will become extremely useful if those Tier 3 credits suddenly become topical, jump up our coverage hierarchy and we are called upon to form a more robust credit view, quickly.

Short-term earnings predictions

Some forecasting is done to prepare for the next earnings season, to prevent surprises, or at least reduce reaction times and speed up decision-making when they occur. A point-estimate of the next quarter’s EBITDA may be useful as a quick signpost to whether our view needs to be re-evaluated when a company reports. When available, ‘consensus estimates’ may indicate whether an earnings report has delighted or disappointed investors.

But whilst such earnings ‘beats’ or ‘misses’ can drive investment decisions in the very short term, they aren’t the goal of investment analysis over the medium & long term.

Short-term earnings predictions also help focus the mind and create a readiness to act in the event that results skew dramatically one way or the other. If you’ve spent time (over)thinking the gross margin assumptions, irrespective of how inaccurate your estimates are, you’re clearly much more ready to act than if you had just mindlessly input random numbers into your model. By honing in on the source of difference between your estimate and the reported numbers, it becomes easier and quicker to diagnose the drivers of the earnings surprise e.g. your revenue numbers may have anticipated the quarter’s growth pretty accurately, but you didn’t expect the margin squeeze from distribution costs. Hence your attention is immediately focused on the new information that matters, rather than the noise surrounding it.

Scenario analysis

As we know, the future is far harder to predict than the recent past - the Covid pandemic, geopolitical tensions/wars, and the return of inflation have demonstrated this all too obviously in recent years. Markets tend to anticipate a roughly status-quo environment over the next few earnings periods, and usually they are correct, but when the investment paradigm shifts, it does so dramatically and unpredictably.

At such times, investors rarely have the resources to build elaborate forecast models detailing every potential unexpected shift in the economic and financial environment. But having quick access to a suite of relatively straightforward earnings model templates may allow a broad-brush sensitivity test to be quickly applied to companies within a coverage universe in order to screen for the most significant opportunities or concerns under a variety of scenarios.

Every credit investment decision can be boiled down to ‘am I getting paid sufficiently for the risk I’m taking, when I buy this company’s bonds’. Scenario analysis modeling can therefore be a core part of assessing the risk-reward trade off for a credit investment. The asymmetrical profile of investment returns for credit products demands that we consider our downside risk, even at lower levels of probability. Scenario analysis allows us to understand how far a company’s performance can drop before it finds itself in severe financial difficulty, it runs out of liquidity or its capital structure is broken.

How do analysts really improve their understanding of a company?

All companies are ‘black boxes’ to some extent, and the financials disclosed are rarely sufficient to really understand what is going on ‘behind the figures’. Companies are complicated organizations - some of the factors that will affect future performance are reflected in their accounts, but not all can be reduced to numbers. Qualitative analysis also needs to be layered into the model inputs - hence the more time available for this rather than filling historical data into spreadsheets, the better. But it’s this use of the modeling process to break a company apart and really understand what drives its financial performance that provides the most benefit to the analyst.

"Companies are complicated organizations - some of the factors that will affect future performance are reflected in their accounts, but not all can be reduced to numbers."

Credit analysts appreciate that their knowledge of a company is enhanced through taking the time to build a comprehensive model of a company’s financials. Detailed consideration of each forecast line helps develop the analyst’s understanding of the factors that underpin company performance and demonstrates vulnerabilities that they need to be aware of. In turn, this should inform investment success or failure in the medium and longer-term.

The more granular the information provided by the company, the easier this process should be, as smaller components of performance can be isolated. This is why we like companies to provide geographical and segment data, as it helps us understand the different business or product lines that comprise the whole entity, and allows us to predict different trends within these units. But even when provided with segment revenue and earnings data, it can be hard to really understand what is going on, to really break down what caused the revenue drop or the margin squeeze. Management commentary may provide some hints, but it’s often difficult to translate this quantitatively into forecasts.

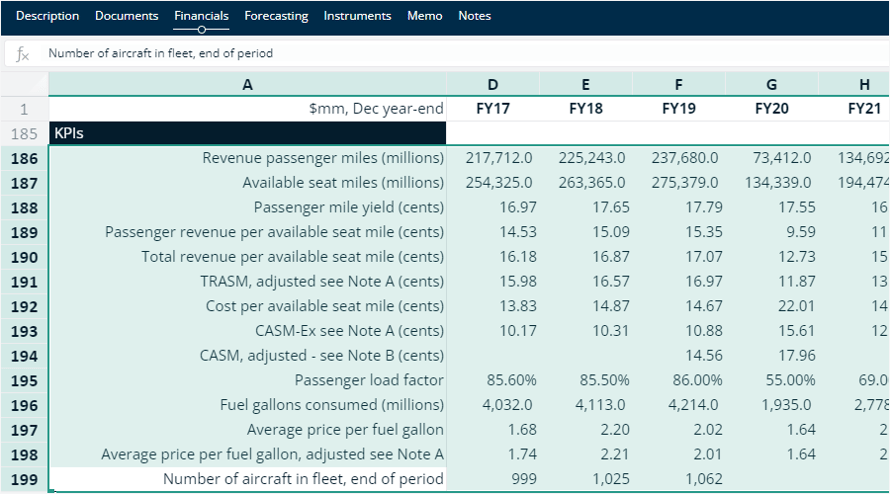

The importance of KPIs in credit analysis

Hence those companies that provide data on Key Performance Indicators (KPIs) make the modeling process that much more likely to succeed. For example:

If we can understand how inflationary pressures are affecting the number of subscribers to a telecom provider’s services, or their average revenue per user, we can really start to understand what’s going on with the business and why changes in revenue occurred and/or how earnings and free cash flow might evolve in future periods.

If we know that a mining company is starting to mine seams with a lower ore grade, we can start to evaluate how its cost per ton might develop adversely over time.

These are the sorts of underlying business developments that drive future financial performance, but also underpin the longer-term investment case for the company’s bonds or equity.

"If we can understand the KPIs and the drivers behind them, we are able to generate a much richer level of knowledge about our current and potential investments."

So the more granular the information, the more KPIs the company provides, the more you actually have a chance of penetrating this black box and coming up with useful point-estimate earnings predictions and scenario analyses, as well as longer-term financial performance forecasts and company valuations. If we can understand the KPIs and the drivers behind them, we are able to generate a much richer level of knowledge about our current and potential investments.

A well constructed model is often less about predicting that 2Q23 EBITDA will be $134.3m, but more a tool to aid understanding of key performance drivers and especially for a credit investor, how far company performance can be pushed before it breaks. And then, once broken, whether it can be repaired, or by how much its capital structure needs to be resized. The use of KPIs in such analysis is invaluable - especially if you are considering whether a different management team or strategy could generate better revenue, earnings or cash flow from the same underlying customer base, for example.

Additionally, by focusing on the KPIs that are actually driving company performance, the analyst may uncover important insights that can be qualitatively investigated with management or industry experts, further enhancing their knowledge of the company or industry concerned. “Why are Netflix’s subscription growth rates decelerating in this region - has it reached a ceiling for market penetration in this geography?”

KPIs are now available on Cognitive Credit

Cognitive Credit’s team of experienced credit market professionals understands the importance of analyzing and interpreting KPI data when making credit investment decisions. For many years, we have manually built our own credit models utilizing such data. Therefore we are pleased to report that following recent enhancements to our machine reading capabilities, we are now able to include KPI disclosure in our detailed financial models.

Image: The new KPIs section in Cognitive Credit financial models

We have begun to backfill this data across our European and US coverage universes, starting with the Airlines, Telecommunications and Oil & Gas industries. In the coming months, we will be rolling KPIs out across other sectors. Our clients can now quickly and easily use this KPI data to improve their credit analysis and form their own view, faster.

To find out more about our KPI data, contact us today.