3 months on from our last analysis, we’re once again diving into our datasets to identify volatility in bond markets - because there’s always something going on in credit markets.

Why does Bond Volatility matter? Because volatility is an indicator of opportunity. Once a bond has made a significant price move in a short period of time, it is more likely to make that kind of move again. This was illustrated by the Altice example in our previous analysis.

So, without further delay, here’s our Volatility analysis for February 2024.

Market Volatility between Nov 23 to Feb 24

As always, we’ve used a 7 point hurdle for our analysis: If a bond moved through a 7 point range over the previous 5 closes, we classify that as a volatility event.

All data used is available via the Cognitive Credit web application in partnership with S&P Global.

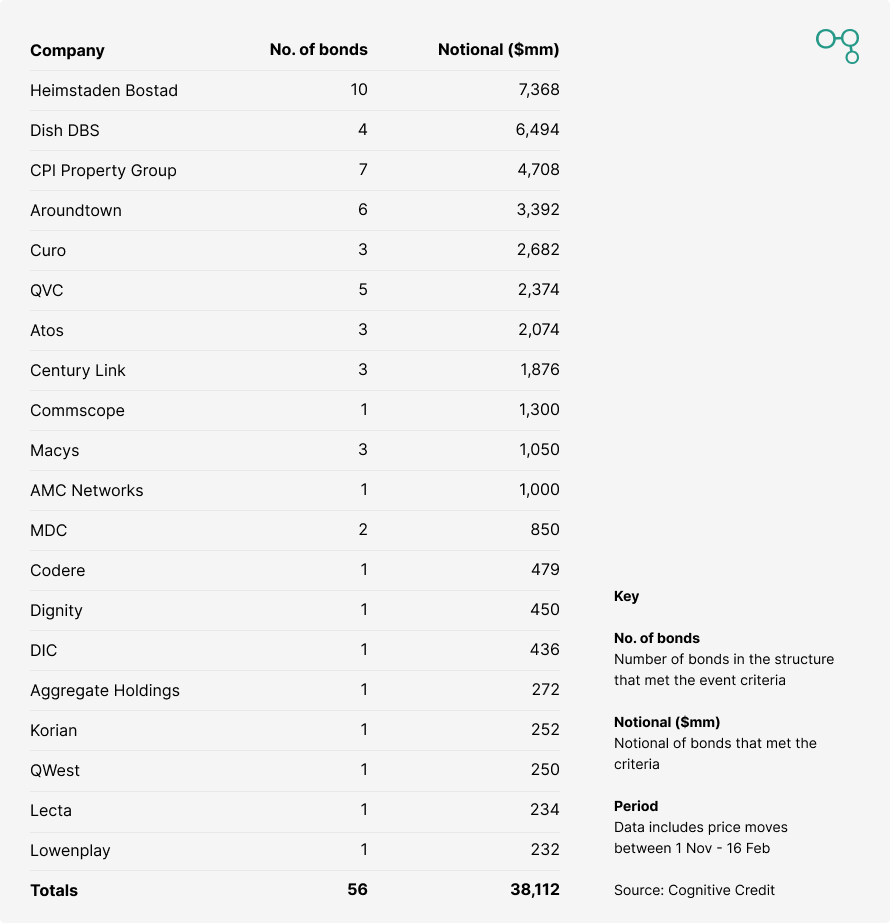

Here’s the list of companies that met the criteria:

15 out of the 20 names that met the criteria to trigger a volatility event in the last 3 months had already triggered at least one volatility event in the last 12 months. Missing the first move doesn’t mean you’ve missed the opportunity - the big moves will come again.

As always, not every one of these opportunities will interest every type of investor, the opportunity set is quite diverse. We’ve picked out a few of the names and added some additional insight from the analytics available in our web application below.

Special situations

Ongoing

Our users have been focussed on Atos since the middle of last year, which we flagged in our November piece. Atos reports their next set of numbers at the end of the month and, for European investors, this has to be a name you have your own opinion on.

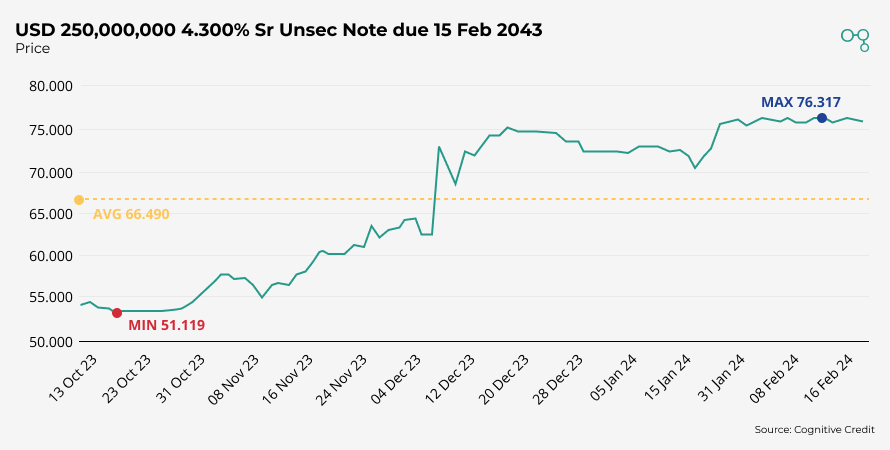

The Macy’s cap structure - with over $3bn of debt outstanding - triggered a volatility event on numerous longer dated bonds in mid-December. Surprisingly, on a LTM basis, the bonds had not triggered an event and have been “stable in the 50s and 60s” for much of the year.

Returning

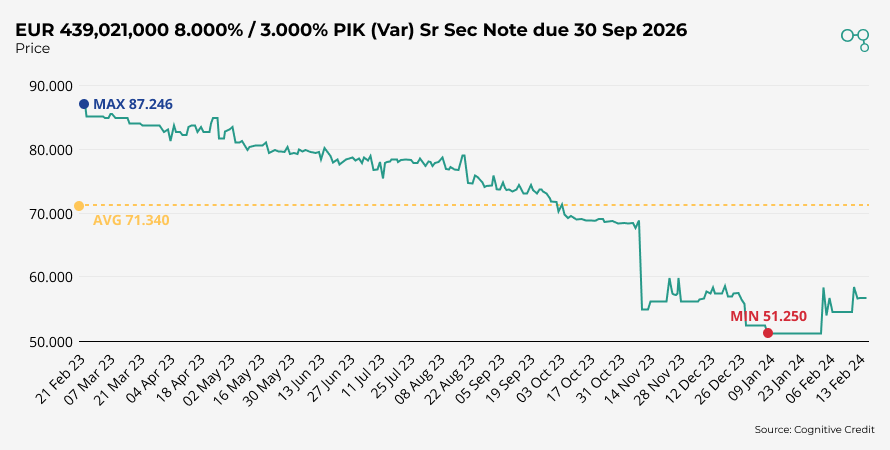

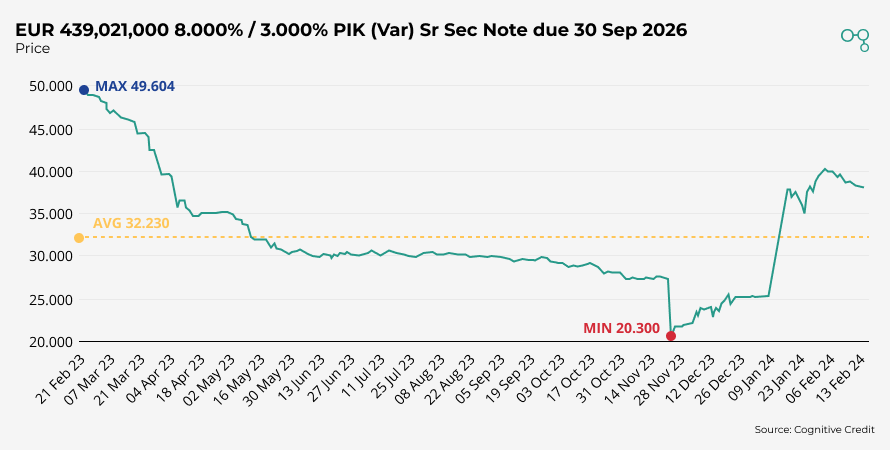

It’s always interesting to see a name that those with a long enough memory will know from previous special situations. While CODERE bonds didn’t trigger an event until the beginning of November, price action since then has continued to be volatile.

Distressed

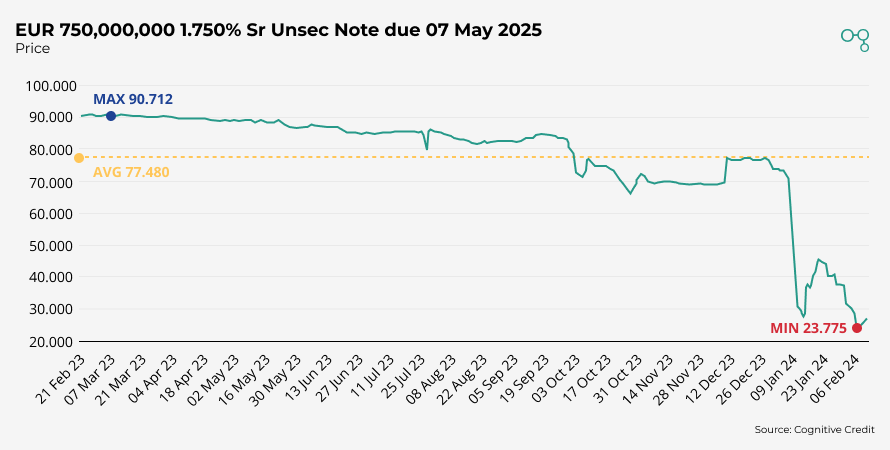

There are a number of companies with bond’s trading below a 40 cash price. Atos (again), CPI Property Group, Curo Group, Branicks, Lumen, and Dish DBS.

CPI Property Group’s recent spike higher followed soon after the initial volatility event in mid-November.

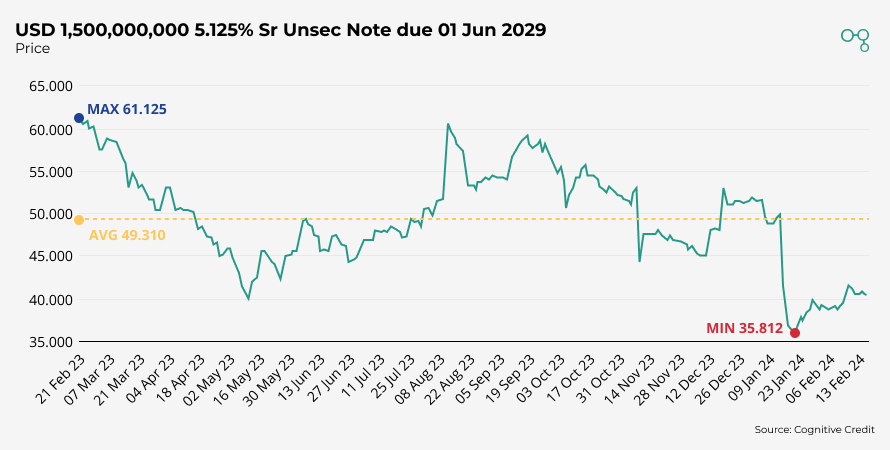

Dish DBS is another one of those names that every US HY account should have their own view on, having triggered multiple volatility events over the past 12 months. With over $2bn of debt due in November 2024, and another $4.75bn in 2026 and the bonds trading at 40, it is unlikely that we won’t see this name again and again through 2024.

Market Volatility between Nov 23 to Feb 24

We recently published our first Sector in Focus piece looking at Real Estate names in the application. 25% of the names triggering events in the last 3 months operate within the real estate space: aggholdings, aroundtown, cpi, branicks, heimstadenbostad.

If you need to learn more about how Cognitive Credit can help you analyze these names, be sure to check out the Sector in Focus: Real Estate blog post.

Why do price moves matter?

Why look at price moves that have already happened? Because, as we discovered in our original post, with volatility comes opportunity. A bond that triggers an event is 20x more likely to appear on our Volatility list again than a bond in our coverage universe that hasn’t.

With Cognitive Credit, you can conveniently track market volatility and stay current on as many names as you need. With ready-to-use, fully customizable financials, you can form your own view quickly and easily maintain it with instant earnings updates.

And with built-in analytics, you can interrogate every metric, financial statement and instrument to enhance your understanding of an issuer.

To try it for yourself, request your demo today.